Loading

Get Nm Trd Acd-31075 Instruction Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NM TRD ACD-31075 Instruction Form online

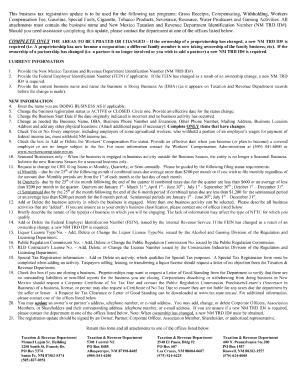

Filling out the NM TRD ACD-31075 Instruction Form online can seem daunting, but with clear guidance, you can navigate it confidently. This guide will provide you with step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to successfully complete the NM TRD ACD-31075 Instruction Form.

- Click the ‘Get Form’ button to access the form and open it in your preferred format.

- Begin by entering your personal information in the designated fields. This typically includes your full name, address, and contact details. Ensure accuracy as this information is vital for processing.

- Next, follow the instructions to fill in any specific identifiers required for your submission. This may involve numbers, codes, or other relevant data unique to your situation.

- Continue to the subsequent sections of the form, and carefully input the information as outlined in the instructions provided. Each section will guide you on what details are necessary, so read them closely.

- After completing all sections, review your entries for any errors or omissions. It is important that all fields are filled out correctly to avoid processing delays.

- Once you are satisfied with your form, you can choose to save your changes. The options may include downloading a copy for your records, printing the form, or sharing it as needed.

Take the first step towards completing your documents online today!

Related links form

To obtain a New Mexico Business Tax Identification Number (NMBTIN), you need to register with the New Mexico Taxation and Revenue Department. You can do this online through their website or by submitting the necessary forms in person. This number is vital for taxes and allows your business to operate correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.