Loading

Get Nj Nj-1040 Schedule A B C 1997

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ NJ-1040 Schedule A B C online

Filling out the NJ NJ-1040 Schedule A B C is an essential step for individuals seeking to accurately report their income and claim necessary credits. This guide provides detailed instructions to help you seamlessly navigate the online form filling process.

Follow the steps to fill out the NJ NJ-1040 Schedule A B C online.

- Press the ‘Get Form’ button to access the NJ NJ-1040 Schedule A B C form and open it in your preferred editing interface.

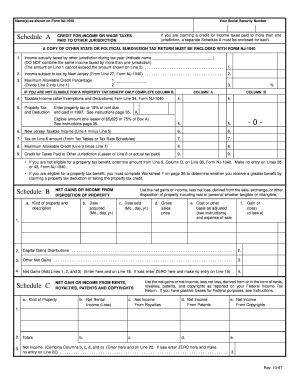

- Begin by entering your name(s) as shown on Form NJ-1040 at the top of the form. Accurate identification is crucial for the processing of your tax return.

- Input your Social Security Number in the designated field. Ensure this information is entered correctly to avoid delays.

- If applicable, indicate any income tax credits for taxes paid to other jurisdictions. Remember to include a separate Schedule A for each jurisdiction.

- Complete Line 1 by entering the income that was taxed by other jurisdictions during the tax year. Attach a copy of the relevant state or political subdivision return.

- On Line 2, list the income subject to tax by New Jersey as indicated on Line 27 of Form NJ-1040. Ensure this aligns with your overall income reporting.

- Calculate the Maximum Allowable Credit Percentage on Line 3 by dividing Line 2 by Line 1. This figure is essential for moving forward.

- Proceed to fill out the property tax and deduction sections. Only complete Column A or B based on your eligibility for property tax benefits.

- For Lines 4 and 5, enter your taxable income and any property taxes or rent amounts paid as specified by the form instructions. Calculate the eligible amounts accordingly.

- On Line 6, subtract Line 5 from Line 4 to find your New Jersey taxable income. This amount will be used for tax calculations.

- Determine the tax on the amount from Line 6 using the appropriate tax tables or schedules as reference, entering this on Line 7.

- Complete Line 8 by calculating your Maximum Allowable Credit based on Line 3 multiplied by Line 7 to find the maximum tax credit you can claim.

- Finalize the form by completing Line 9 with the lesser of Line 8 or the actual tax paid to another jurisdiction. Save your form.

- Once you have completed all sections of the form, you can save changes, download, print, or share it as needed.

Take action today and complete your NJ NJ-1040 Schedule A B C online for successful filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Claiming medical expenses on your taxes can be beneficial if your total expenses exceed the required threshold. If applicable, deducting these costs on the NJ NJ-1040 Schedule A can significantly reduce your tax burden. It’s worth evaluating your annual medical expenses to determine the potential benefits. Keep thorough records to support your deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.