Loading

Get Nj Form Ptr-1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ Form PTR-1 online

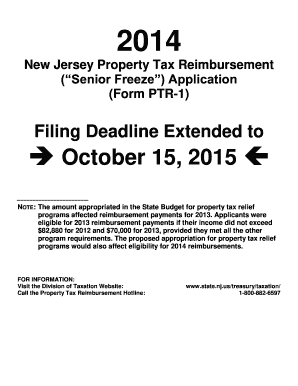

Completing the NJ Form PTR-1 online is essential for requesting a property tax reimbursement in New Jersey. This comprehensive guide will walk you through each section of the form, ensuring that you understand the requirements and can complete it accurately.

Follow the steps to successfully complete the NJ Form PTR-1.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out your personal details by entering your social security number, last name, first name, and any joint applicant’s information accurately.

- Enter your home address, including your county/municipality code and zip code. Ensure that the preprinted information is correct before proceeding.

- Indicate your marital or civil union status for December 31, 2013, and December 31, 2014, by checking the appropriate boxes.

- Provide information regarding your age or disability status as of December 31 for both years by checking ‘Yes’ or ‘No’ for yourself and your spouse or civil union partner.

- Answer residency questions to verify continuous residence in New Jersey since December 31, 2003, and homeownership since December 31, 2010.

- Complete the income details for 2013 and 2014 by entering annual income across various categories. If necessary, combine incomes if married or in a civil union and living together.

- Enter your property tax details for both years as required; ensure you have proof of property taxes due and paid for submission.

- Calculate your reimbursement amount by subtracting total property taxes for 2013 from total property taxes for 2014.

- Sign and date the form. If applicable, ensure both you and your spouse or civil union partner sign if applying jointly.

- Finally, review all entered information, save changes, download, print, or share the completed application as needed.

Complete your NJ Form PTR-1 online today for a hassle-free reimbursement process!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The new tax law for seniors in New Jersey focuses on enhancing property tax relief options. It expands the eligibility criteria for programs like the Property Tax Reimbursement, which seniors can access through NJ Form PTR-1. This law represents a significant step towards providing much-needed financial support for senior homeowners.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.