Loading

Get Nj Dot Rtf-3 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ DoT RTF-3 online

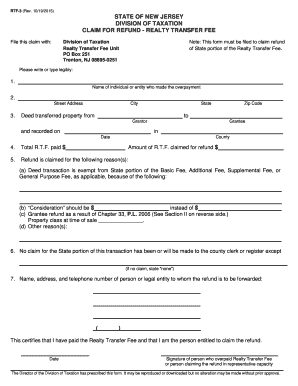

Filling out the NJ DoT RTF-3 form online is a straightforward process that allows users to claim a refund for overpayment of the Realty Transfer Fee. This guide will provide you with step-by-step instructions to ensure you complete the form correctly and efficiently.

Follow the steps to successfully complete the NJ DoT RTF-3 form.

- Press the 'Get Form' button to access the RTF-3 form and open it in the designated editor.

- Input the name of the individual or entity who made the overpayment in the first field. Ensure that the information is clear and correct.

- Fill in the street address of the individual or entity in the second field. This should represent the primary address where communications can be sent.

- Enter the city, state, and zip code in the next section to provide complete location information.

- Detail the transaction by filling in the names of the grantor and grantee, along with the date and county of the deed.

- Indicate the total Realty Transfer Fee paid and the amount you are claiming for a refund.

- Select the appropriate reason for claiming the refund from the provided options. Ensure to include a detailed explanation if applicable.

- Certify that no other claim for the State portion of this transaction has been made or will be made, noting 'none' if applicable.

- Provide the name, address, and telephone number of the person or legal entity who should receive the refund.

- Sign and date the form where indicated to verify that the information provided is accurate and complete.

- Once all fields are filled out, you can save your changes, download the completed form, or print it for mailing.

Complete your NJ DoT RTF-3 form online today to submit your claim for a refund.

Related links form

The NJ Anchor benefit is determined by a household's income and the type of property ownership, with specific guidelines provided by the state. The benefit is directly influenced by your filing status, ensuring fairness among different homeowners. For those completing the NJ DoT RTF-3 form, understanding these calculations can significantly enhance your financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.