Loading

Get Ca Ftb 3582 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3582 online

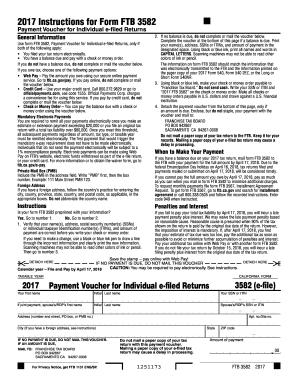

Filling out the CA FTB 3582, also known as the Payment Voucher for Individual e-filed Returns, can seem daunting at first. This guide will provide you with clear, step-by-step instructions to ensure a smooth and accurate submission process for your payment voucher.

Follow the steps to fill out the CA FTB 3582 online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your editing space.

- If your form FTB 3582 is preprinted with your information, verify that your name(s), address, social security number(s) or individual taxpayer identification number(s), and amount of payment are accurate. If there are errors, use a black or blue ink pen to strike through the incorrect information and write the correct details. If there is no preprinted information, proceed to the next step.

- Complete the fields for your name(s), address, SSNs or ITINs, and amount of payment. Ensure to use capital letters when printing your information and only black or blue ink, as other colors may not be read by scanning machines.

- Make your payment using either a check or money order made payable to 'Franchise Tax Board.' Write your SSN or ITIN and '2017 FTB 3582' on the payment method. Avoid sending cash. The payment should be in U.S. dollars from a U.S. financial institution.

- Detach the payment voucher from the bottom of the form. Enclose your payment with the detached voucher, but do not staple it, and mail to: Franchise Tax Board, PO Box 942867, Sacramento CA 94267-0008.

- Retain a copy of your tax return for your records. Do not send a paper copy of your e-filed tax return to the FTB, as this may delay the processing of your payment.

- Ensure that your payment is postmarked by the due date of April 17, 2018, to avoid penalties and interest.

Complete your documents online to save time and ensure accuracy!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

CA Form 565 must be filed by partnerships operating within California. This includes general partnerships, limited partnerships, and limited liability companies taxed as partnerships. Each partner must also report their share of income on their personal tax returns. To keep organized, consider using guidance from CA FTB 3582 when navigating partnership tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.