Loading

Get Nj Cbt-100-v 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100-V online

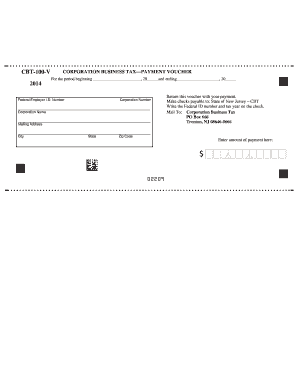

The NJ CBT-100-V is a payment voucher used for the Corporation Business Tax in New Jersey. This guide will provide you with clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to successfully complete the NJ CBT-100-V form.

- Click the ‘Get Form’ button to access the NJ CBT-100-V document and open it for editing.

- Enter the beginning and ending dates for the tax period in the designated fields at the top of the form. Ensure the dates are clearly marked in the format of month, day, and year.

- In the space provided, input your Federal Employer Identification Number (EIN). This is essential for identifying your corporation within the tax system.

- Fill in your corporation's number accurately in the next field, which helps in uniquely identifying your business.

- Enter your corporation's name as it appears in your formation documents. This ensures proper alignment with state records.

- Provide a complete mailing address for your corporation, including the street address, city, state, and zip code. Make sure this information is accurate for any correspondence regarding your payment.

- Indicate the amount of payment you are submitting in the appropriate field. Double-check the figure for accuracy to avoid issues.

- After completing the form, you can choose to save your changes, download a copy for your records, print the voucher, or share it as needed.

Complete your NJ CBT-100-V form online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you qualify for a tax rebate in New Jersey, you can typically expect your NJ rebate check within 8 to 12 weeks after filing. However, processing times may vary based on volume and your specific tax situation. For the most up-to-date information, always check with the New Jersey Division of Taxation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.