Loading

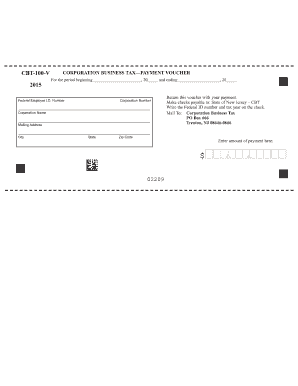

Get Nj Cbt-100-v 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ CBT-100-V online

Filling out the NJ CBT-100-V form online is a straightforward process that can help you manage your business tax obligations seamlessly. This guide provides comprehensive, step-by-step instructions to assist you in completing each section of the form accurately and efficiently.

Follow the steps to complete the NJ CBT-100-V online

- Click ‘Get Form’ button to access the NJ CBT-100-V form and open it in the online editor.

- Begin by entering your business name at the top of the form, ensuring that it matches the name registered with the New Jersey Division of Revenue.

- Input your business identification number (BIN). You can find this number on previous tax documents or your business registration.

- Provide the tax year for which you are filing, specified as the year that the form covers.

- Complete the section regarding the type of business entity. Indicate whether you are a corporation, limited liability company, or a different type of business.

- Fill in the financial figures, such as total income and expenses, as required in the respective fields.

- Review the calculation of the tax due based on the entries made in the earlier sections to ensure accuracy.

- Once all information is completed, you can choose to save your changes, download the completed form, or print it for your records.

Start filling out your NJ CBT-100-V form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The $700 rebate in NJ is part of the state's efforts to provide financial relief to certain homeowners and tenants. This rebate is typically aimed at those who qualify based on their income and property criteria. Understanding your eligibility is crucial, and you can find useful information on platforms like US Legal Forms to help navigate the application process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.