Loading

Get Nh Dor Bt-summary 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NH DoR BT-SUMMARY online

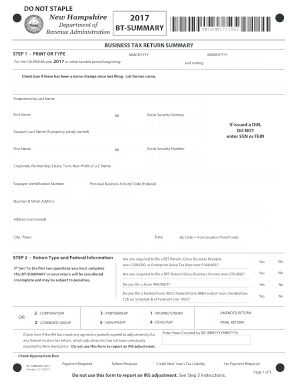

The NH DoR BT-SUMMARY is an essential document for individuals and businesses filing their taxes in New Hampshire. This guide provides a clear and detailed approach to completing the form online, ensuring users understand each component and can accurately submit their information.

Follow the steps to complete the NH DoR BT-SUMMARY online.

- Press the ‘Get Form’ button to access the NH DoR BT-SUMMARY form and open it in the editor.

- Begin filling out the form with your information. Start with Step 1 by providing the tax year and relevant dates, ensuring to check the box if there has been a name change since your last filing. Input your name, Social Security Number, and address. If applicable, include the spouse's information.

- Continue to Step 2, where you will indicate whether you are required to file a Business Enterprise Tax (BET) Return and a Business Profits Tax (BPT) Return. This section also requires you to indicate any associated federal forms.

- In Step 3, complete any BET and/or BPT returns and attach them to the BT-SUMMARY.

- Proceed to Step 4 to calculate your balance due or any overpayment. Complete the required fields related to business tax amounts, payments made, and any due or overpayment amounts.

- Finally, in Step 5, ensure the document includes your signature and information as well as that of any preparer if applicable. Be sure to check any relevant boxes and review the integrity of your submission.

- Once you have filled in all required fields, review your information for accuracy. You can then save the changes, download the document, print it, or share it as needed.

Complete your NH DoR BT-SUMMARY online today for a hassle-free tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can obtain NH tax forms directly from the New Hampshire Department of Revenue website, where all necessary documents are available for download. Alternatively, resources like the US Legal Forms platform offer easy access to various tax forms and guidance. Utilizing the NH DoR BT-SUMMARY ensures you have the correct forms for your specific tax needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.