Loading

Get Ne Dor Form 6 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NE DoR Form 6 online

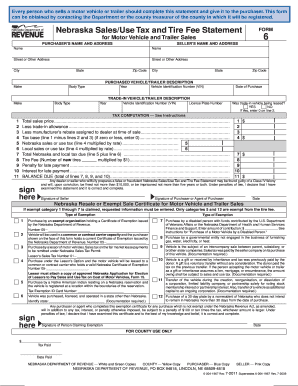

Filling out the NE DoR Form 6 online is an essential step for anyone selling a motor vehicle or trailer in Nebraska. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the NE DoR Form 6 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the purchaser’s name and address in the designated fields. Ensure all information is accurate, including street address, city, state, and zip code.

- Provide the seller’s name and address similarly. Verify that all details are entered correctly to avoid any processing issues.

- Fill in the purchased vehicle or trailer description. This includes make, body type, year, vehicle identification number (VIN), and the date of purchase.

- If applicable, describe any trade-in vehicles or trailers by filling in their make, body type, year, VIN, and license plate number. You will also need to indicate whether the trade-in vehicle was leased.

- Proceed to the tax computation section. Fill in the total sales price, less any trade-in allowance or manufacturer’s rebate as outlined in the instructions.

- Calculate the tax base by subtracting the allowances from the total sales price. Make sure this amount is zero or more.

- Enter the Nebraska and local sales or use tax amounts based on the calculated tax base.

- Complete the tire fee section if applicable, detailing the number of new tires purchased.

- Read through the declaration part regarding penalties for false information and sign the form as the seller.

- The purchaser or their agent must sign as well, including the date of signing.

- Once all fields are completed and verified, you may save your changes, download the document, print it, or share it as needed.

Complete your NE DoR Form 6 online today to facilitate your motor vehicle or trailer transaction!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To verify a Nebraska resale certificate, you can check with the Nebraska Department of Revenue by contacting their office directly. Additionally, you may request the customer to provide their NE DoR Form 6 for your records. Ensure the form is filled out correctly and includes valid information about the buyer’s business operations. This process helps prevent fraudulent transactions and ensures compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.