Loading

Get Mo Cdtc-770 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO CDTC-770 online

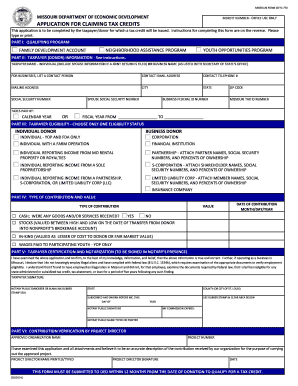

This guide provides a comprehensive overview of the MO CDTC-770 form, specifically designed for individuals and businesses seeking tax credits for eligible contributions. Follow the step-by-step instructions to ensure a smooth online application process.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part I, select only one qualifying program: Neighborhood Assistance Program, Family Development Account, or Youth Opportunities Program.

- Proceed to Part II and provide the taxpayer or donor's complete information, including name, contact details, social security number (for individuals), federal ID number (for businesses), and mailing address.

- Indicate whether taxes are paid by calendar year or fiscal year. If fiscal year is selected, enter the appropriate dates.

- In Part III, select one taxpayer eligibility status that accurately represents your situation, whether you are an individual or business donor.

- Next, move to Part IV to specify the type of contribution and its value. You may need to provide additional details depending on whether it is cash, stocks, in-kind contributions, or wages paid.

- Once all information is filled in, go to Part V to sign the form. Ensure that you sign in the presence of a notary public.

- Finally, in Part VI, the project director of the approved organization must verify the contribution details, sign, and date the form before it is submitted.

- Review the form thoroughly for any errors. Once satisfied, save your changes, download, print, or share the completed form as needed.

Complete your MO CDTC-770 online today to ensure prompt processing of your tax credit application.

Yes, earning a minimum of $2,500 is generally required to qualify for the Child Tax Credit. This threshold is crucial as it determines eligibility based on your income level. For individuals navigating this aspect in Missouri, the MO CDTC-770 provides clarity on how to maximize your credit benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.