Loading

Get Nc Oic-101 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC OIC-101 online

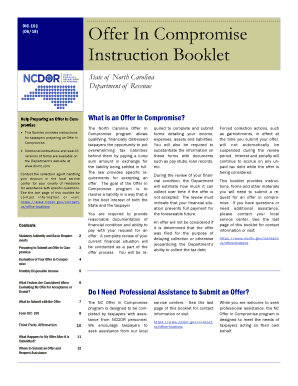

The NC OIC-101 form is essential for taxpayers who wish to submit an Offer in Compromise to settle their state tax liabilities. This guide provides a step-by-step approach to help you complete the form accurately and efficiently, ensuring you have the best chance of acceptance.

Follow the steps to complete the NC OIC-101 form online.

- Press the ‘Get Form’ button to obtain the NC OIC-101 form and open it in the online editor for editing.

- Carefully read the instructions provided in the booklet, focusing on the eligibility criteria for submitting an Offer in Compromise. Ensure all necessary documentation is gathered, as outlined in the instructions.

- Complete the OIC-100 form by entering personal details, including your name, address, and taxpayer identification number. Ensure that all mandatory fields are filled accurately.

- Fill in the OIC-1062 or OIC-1063 Collection Information Statement, depending on whether you are an individual or a business. This section requires detailed financial information.

- Attach any required supporting documentation, such as pay stubs, bank statements, and federal income tax returns, as specified in the instruction booklet.

- Review the completed forms and documents thoroughly to confirm that all information is accurate and complete, including any explanations of circumstances if applicable.

- Submit the forms and supporting documentation to the appropriate service center for your county of residence. Keep copies of everything submitted for your records.

- Pay 20% of the offer amount in certified funds at the time of submission, unless exempted due to income levels or other qualifying factors.

Complete your NC OIC-101 form online today and take the first step towards resolving your tax liabilities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To stop NC state tax garnishment, you typically need to address the underlying tax debt directly with the state. Filing for a release of the garnishment or negotiating a payment plan may also be effective. Resources regarding NC OIC-101 can help you understand your options and the necessary steps to take in these situations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.