Get Nc E-592a 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-592A online

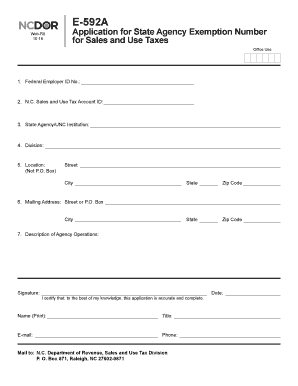

Filling out the NC E-592A form is essential for obtaining a state agency exemption number for sales and use taxes. This guide provides clear and supportive step-by-step instructions to help you accurately complete the form online.

Follow the steps to complete the NC E-592A form online.

- Click the 'Get Form' button to retrieve the NC E-592A form and open it for editing.

- Enter the agency’s Federal Employer Identification Number (FEIN) in the designated field. This number is essential for identifying your agency in tax matters.

- Provide the agency’s North Carolina Sales and Use Tax Account ID Number. This will be used for tracking the agency's tax accounts.

- Input the name of the State Agency or UNC Institution for which you are requesting an exemption number. This ensures the application is linked to the correct agency.

- Fill in the division name of the State agency, if applicable. This helps to further specify the area of your agency.

- Enter the physical location of the State agency, ensuring to provide a full address, excluding P.O. Box information.

- Specify the mailing address for correspondence regarding the exemption number. This can include a street address or a P.O. Box.

- Describe the operations of the State agency. This should summarize the primary activities and responsibilities of the agency.

- Sign and date the application, confirming that to the best of your knowledge, the information provided is accurate and complete.

- Print your name along with your title, phone number, and e-mail address where you can be contacted for any follow-up questions regarding the application.

- Once you have completed all sections, review the form for accuracy. You can then save changes, download, print, or share the form as needed.

Complete the NC E-592A form online to obtain your state agency exemption number quickly and efficiently.

Filling out a withholding exemption form, such as the NC E-592A, involves providing necessary personal information and evaluating your eligibility for exemptions. Make sure to gather all relevant documents to support your claims, such as tax returns from previous years for an accurate assessment. If you’re unsure of how to proceed, uslegalforms provides an array of resources to assist you in completing the form accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.