Loading

Get Nc E-585 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC E-585 online

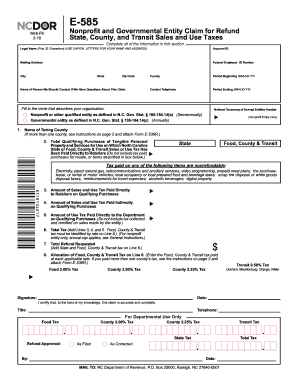

The NC E-585 is a critical document for nonprofit and governmental entities seeking a refund for sales and use taxes paid in North Carolina. This guide provides step-by-step instructions to help users navigate the form effectively and ensure that all necessary information is submitted.

Follow the steps to complete the NC E-585 online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Complete all personal information in the designated fields, including your legal name, account ID, mailing address, federal employer ID number, city, state, and zip code. Ensure to use capital letters for names and addresses as instructed.

- Provide the contact name for inquiries regarding your claim along with their contact telephone number.

- Fill out the period for which you are claiming a refund, specifying both the beginning and ending dates.

- Indicate the type of organization by filling in the appropriate circle to describe your entity—either a nonprofit entity or a governmental entity.

- For nonprofit entities only, enter the name of the taxing county. If applicable, follow instructions for multiple counties.

- Report the total qualifying purchases of tangible personal property and services for which North Carolina sales or use tax has been paid directly to retailers. Exclude tax paid on non-refundable items.

- Document the amount of sales and use tax paid directly to retailers, the amount paid indirectly, and any use tax paid directly to the department for the qualifying purchases.

- Calculate the total tax by adding the amounts from the appropriate lines, ensuring to identify the food, county, and transit tax by rate.

- Finalize your claim by confirming the total refund requested. This includes summing state and food, county, and transit tax from the previous sections.

- Add detailed entries for the allocation of food, county, and transit tax according to the rates applicable for your entity and period.

- Once all sections are completed, save your changes, and download the form. You can print it for mailing or share it as needed.

Complete your NC E-585 online today and ensure you receive your refund promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, North Carolina is currently accepting tax returns for the year. Make sure to use the NC E-585 form for accurate reporting of your income and taxes owed. If you need assistance or want to simplify the process, the US Legal Forms platform offers guidance and access to essential tax forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.