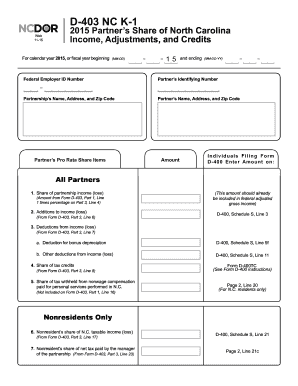

Get Nc Dor D-403 K-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NC DoR D-403 K-1 online

How to fill out and sign NC DoR D-403 K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

In contemporary times, the majority of Americans are inclined to handle their own income tax returns and additionally, complete documents in a digital format.

The US Legal Forms online platform aids in simplifying the process of preparing the NC DoR D-403 K-1, making it convenient.

Ensure that you have accurately completed and submitted the NC DoR D-403 K-1 by the specified deadline. Check for any time limits. Providing incorrect information on your financial documents may result in significant penalties and complications with your annual tax return. Ensure you only utilize certified templates from US Legal Forms!

- Access the PDF template in the editor.

- Identify the designated fillable areas where you can enter your information.

- Select the appropriate option when you observe the checkboxes.

- Explore the Text feature along with other advanced tools to modify the NC DoR D-403 K-1 manually.

- Review all information prior to signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or mobile device.

- Validate your PDF form online and add the date.

- Click on Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get NC DoR D-403 K-1 2015: personalize forms online

Locate the appropriate Get NC DoR D-403 K-1 2015 template and modify it directly.

Streamline your documentation with an intelligent form editing solution for online paperwork.

Your everyday tasks involving documents and forms can be enhanced when you have everything you need consolidated in one location. For instance, you can search for, acquire, and modify the Get NC DoR D-403 K-1 2015 within a single browser window. If you require a particular Get NC DoR D-403 K-1 2015, finding it is simple with the assistance of the intelligent search engine, providing you immediate access.

There is no need to download it or seek out an external editor to alter and input your information. All the tools for efficient work are included within a single comprehensive solution.

Make additional tailored adjustments with the available tools.

- This editing solution enables you to customize, complete, and endorse your Get NC DoR D-403 K-1 2015 form directly.

- When you locate an appropriate template, click on it to enter the editing mode.

- Upon opening the form in the editor, all the necessary tools are readily available.

- You can effortlessly populate the designated fields and remove them if needed using a straightforward yet versatile toolbar.

- Implement all adjustments instantly, and sign the document without exiting the tab by simply selecting the signature area.

Get form

For NC state taxes, you should make your check out to 'North Carolina Department of Revenue.' This ensures that your payment is directed to the correct agency and processed correctly. Always include your tax identification information in the memo to facilitate proper crediting to your account. Using the NC DoR D-403 K-1 can help you understand the nuances of your obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.