Loading

Get Mt Dor Mw-3 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR MW-3 online

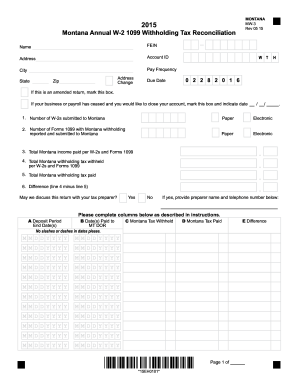

Filing the Montana Annual W-2 1099 Withholding Tax Reconciliation, also known as the MT DoR MW-3, is an essential step for employers to reconcile the withholding taxes for their employees. This guide will provide you with step-by-step instructions to fill out the MW-3 form correctly and efficiently.

Follow the steps to accurately complete the MT DoR MW-3 form.

- Press the ‘Get Form’ button to access and open the MT DoR MW-3 in your preferred editor.

- Begin by entering the total number of W-2s submitted, marking whether they were filed electronically or via paper. This is required to support your MW-3 reconciliation.

- Next, provide the total number of Forms 1099 with Montana withholding submitted, again indicating whether these were filed electronically or by paper.

- Fill in the total Montana income paid as reported on the W-2s and Forms 1099.

- Enter the total Montana withholding tax withheld per W-2s and 1099s on the specified line.

- Complete the line indicating the total amount of Montana withholding tax that has been remitted to the Department of Revenue.

- Calculate and enter the difference between the total withholding tax withheld and the total paid. This will show any discrepancies.

- Proceed to fill out the reconciliation table. Complete columns A through E as instructed, ensuring dates and amounts are entered accurately.

- Once all fields are completed and reviewed for accuracy, you can proceed to save changes, download the form, print it for your records, or share it as needed.

Complete your MT DoR MW-3 online now to ensure timely processing of your tax reconciliation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, Montana has a withholding tax system for employers who must withhold state income tax from employee wages. This tax helps ensure that employees fulfill their state tax responsibilities. For detailed guidance on compliance, including submitting the MT DoR MW-3, visit the Montana Department of Revenue's site or similar resources.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.