Get Mt Dor Apls101f 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR APLS101F online

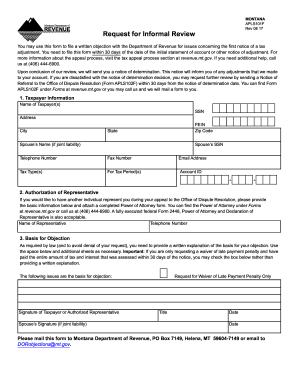

The MT DoR APLS101F is a crucial form for filing a written objection with the Department of Revenue regarding tax adjustments. This guide provides step-by-step instructions on how to complete the form online, ensuring users can navigate the process with ease.

Follow the steps to successfully complete the MT DoR APLS101F form.

- Press the ‘Get Form’ button to access the MT DoR APLS101F. This action will load the form in your browser, ready for you to fill out.

- Begin with the 'Taxpayer Information' section. Enter the name of the taxpayer(s), social security number (SSN), address, city, state, zip code, and phone number. If there is a spouse involved in the liability, their name and SSN must also be included.

- Provide the applicable tax type(s) and the period for which the adjustment is in question. Additionally, include the email address and account ID for reference.

- If someone is representing you during this process, fill in the 'Authorization of Representative' section with their name and telephone number. Remember to attach a completed Power of Attorney form, if applicable.

- In the 'Basis for Objection' section, provide a detailed written explanation of your objection. If relevant, check the box for a waiver of late payment penalty if you have paid the assessed amount within 30 days of the notice.

- Ensure that the signature of the taxpayer or authorized representative, as well as the spouse's signature (if applicable), is included at the end of the form along with the date.

- Once you complete all sections, review the form for accuracy. You can then save changes, download a copy, print, or share the completed form as needed.

Complete your MT DoR APLS101F online today to ensure your objections are filed promptly.

Related links form

An EIN is not the same as a state tax ID; they serve different purposes. The EIN is a federal identification number required by the IRS, while a state tax ID is necessary for state tax filings and compliance. If you're managing a business in Montana, both IDs may be critical for your tax responsibilities. For further clarification, the MT DoR APLS101F resources on our site can help answer any questions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.