Loading

Get Ms Dor 96-101 (formerly 66-066) 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS DoR 96-101 (Formerly 66-066) online

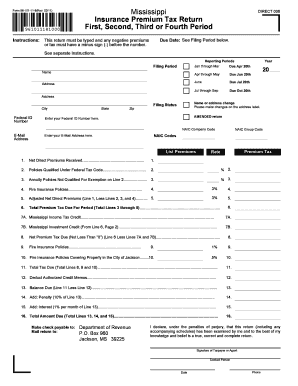

Filling out the MS DoR 96-101, the Mississippi Insurance Premium Tax Return, online can streamline the process and ensure accuracy. This guide provides clear instructions to help users navigate each section of the form with confidence.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the MS DoR 96-101 and open it in your preferred editor.

- Begin by entering your name and address in the designated fields to ensure the Department of Revenue has your correct information.

- Input your Federal ID number, ensuring accuracy to prevent any filing issues.

- If there are any changes to your name or address, indicate those changes on the address label provided.

- Select your filing status by checking the appropriate box, indicating if this is an amended return.

- Complete the sections detailing the premiums received and the specific categories as indicated on the form, such as net direct premiums and policies that qualify for specific tax codes.

- Calculate the total premium tax due by summing the premiums from the relevant lines (3 through 5) to arrive at the total amount.

- Enter any income tax credits or investment credits that apply to your return.

- Determine the net premium tax due, ensuring it is not less than zero, by subtracting the credits from the total premium tax.

- Calculate any additional amounts due, including penalties or interest for late payments, if applicable.

- Review all entries for accuracy and completeness before finalizing the form.

- Save your changes, and then choose to download, print, or share the completed form as needed.

Complete your MS DoR 96-101 form online today for a smooth filing experience.

Individuals who earn income in Montana, whether they reside there or are non-residents, may have a requirement to file. Understanding the specifics under laws like MS DoR 96-101 (Formerly 66-066) can help clarify your situation. Ensure you assess your income levels and residency status to determine your obligations. For more information, you can explore resources offered by uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.