Loading

Get Ca Ftb 3533 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3533 online

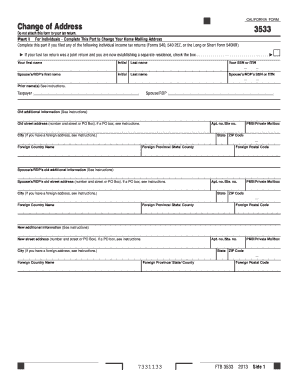

The CA FTB 3533 form is essential for individuals and businesses looking to update their address with the California Franchise Tax Board. This guide provides you with clear and supportive instructions on how to complete the form online, ensuring that your new address is updated efficiently and accurately.

Follow the steps to complete the CA FTB 3533 online.

- Press the ‘Get Form’ button to access the CA FTB 3533 form and open it in the online editor.

- In Part I, if applicable, fill in your first name, middle initial, last name, and your social security number (SSN) or individual taxpayer identification number (ITIN). If you filed a joint return, also include your partner's name and SSN/ITIN.

- Enter your old street address, ensuring to include your apartment number or suite number if relevant. Fill in the city, state, and ZIP code accurately. If you have a foreign address, provide the necessary foreign details.

- Proceed to fill in your new street address in the designated fields. Again, include any applicable apartment number or suite number. Provide the new city, state, and ZIP code, ensuring it matches your relocation details.

- If you completed Part II for a business, fill in the business, estate, or trust name, along with California corporation number or FEIN as required. Include both old and new mailing addresses for the business.

- Once all the sections are completed, locate the signature fields; both you and your partner, if applicable, must sign and date the form to validate it.

- Finally, review all entries for accuracy and completeness. Save changes, download, print, or share the form as needed.

Ensure your address is updated properly by completing the CA FTB 3533 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

An EIN, or Employer Identification Number, is not the same as a resale number. The EIN is issued for tax purposes and identifying your business entity, while a resale number is specifically for purchasing goods intended for resale. Understanding this distinction is critical for compliance with CA FTB 3533.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.