Loading

Get Ms 90-100-10-1 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MS 90-100-10-1 online

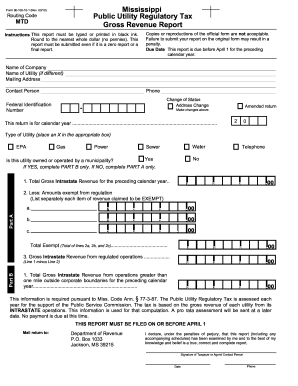

The MS 90-100-10-1 is a crucial document for reporting gross revenue for public utilities in Mississippi. This guide will provide you with clear, step-by-step instructions to complete the form easily and accurately online.

Follow the steps to fill out the MS 90-100-10-1 effectively.

- Use the ‘Get Form’ button to access the MS 90-100-10-1 and open it in the document editor.

- Fill in the 'Name of Company' field with the official registered name of your utility company.

- If your utility has a different official name, fill in the 'Name of Utility' field accordingly.

- Provide your complete 'Mailing Address' where correspondence should be sent.

- Indicate the 'Contact Person' who can provide additional information regarding the report.

- Include the 'Phone' number of the contact person for any inquiries related to the filing.

- Enter your 'Federal Identification Number' as required for identification purposes.

- If applicable, check the box for 'Change of Status', 'Address Change', or 'Amended Return' and make necessary changes.

- Specify the reporting year in the section labeled 'This return is for calendar year'.

- For 'Type of Utility', place an X in the box that corresponds to your utility type: Gas, Power, Water, or Sewer.

- Respond to the question about whether your utility is municipality-owned by checking 'Yes' or 'No', and follow the corresponding instructions.

- In Part A, report your total gross revenue and any exempt amounts from regulated operations, rounding figures to the nearest whole dollar.

- In Part B, if your utility is municipality-owned, complete the required sections and provide necessary revenue information.

- Verify that all fields are filled out completely and accurately before submitting.

- Save any changes made to the form, and select the option to download, print, or share the filled-out document as needed.

Prepare and file your MS 90-100-10-1 online to ensure compliance and avoid penalties.

Yes, the MCS-90 endorsement is mandatory for motor carriers operating commercial vehicles that transport goods across state lines. This requirement ensures financial responsibility and protection for the public. It’s a crucial part of adhering to MS 90-100-10-1 regulations and maintaining compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.