Loading

Get Mo W-3 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO W-3 online

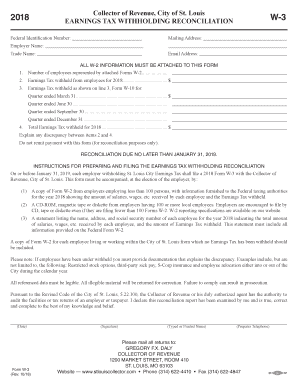

Completing the MO W-3 form is a crucial step for employers to reconcile earnings tax withholding in St. Louis. This guide provides clear instructions to help you navigate the online preparation of this form with confidence.

Follow the steps to accurately prepare the MO W-3 electronically.

- Press the ‘Get Form’ button to obtain the MO W-3 form and open it in your preferred editing tool.

- Enter your Federal Identification Number at the top of the form. This number is essential for proper identification and processing.

- Input your employer name in the designated field. Make sure this matches the name you use for tax purposes.

- Provide your mailing address in the appropriate field, ensuring all components are accurate for correspondence.

- Fill in the trade name of your business, if applicable. This helps clarify your business identity.

- Include your email address for any communications regarding your submission or for follow-up inquiries.

- Attach all relevant W-2 information as indicated. This is mandatory to complete the form effectively.

- Indicate the number of employees represented by the attached Forms W-2. This should accurately reflect your records.

- Document the total earnings tax withheld from employees for the year 2018 in the corresponding field.

- Break down earnings tax withheld as shown on line 3 of Form W-10 for each quarter of the year. Enter amounts specifically for March 31, June 30, September 30, and December 31.

- Sum the total earnings tax withheld for 2018 and ensure that this reflects correctly in the space provided.

- Explain any discrepancies between the totals reported in items 2 and 4. Attach any supporting documentation as needed.

- Sign and date the form to affirm that the information presented is accurate to the best of your knowledge.

- Finalize your form by saving your changes. Now you can download, print, or share the completed MO W-3 for submission.

Start preparing your MO W-3 online today to ensure compliance before the submission deadline!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out your Missouri W4 involves entering your personal information and determining how many allowances you want to claim. Be sure to follow the instructions carefully to avoid mistakes that could lead to incorrect withholding. If you require more help, uslegalforms offers tools and guides tailored to ensure you complete your W4 correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.