Loading

Get Mo Mo-99 Misc 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-99 MISC online

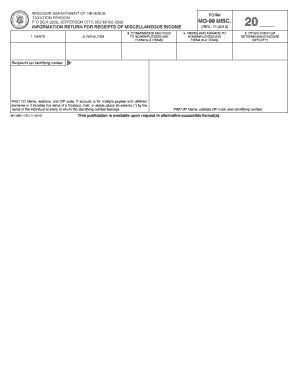

The MO MO-99 MISC form is designed to report miscellaneous income received by individuals or entities. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to complete the MO MO-99 MISC form effectively.

- Click ‘Get Form’ button to access the online version of the form and open it for editing.

- Enter the recipient’s tax identifying number in the designated field. Ensure accuracy to avoid delays in processing.

- In the income sections, specify the type of miscellaneous income: royalties, commissions and fees to nonemployees, prizes and awards, or other fixed or determinable income. Be specific about the type of income by selecting the appropriate option.

- For each type of income selected, fill in the 'Paid To' section with the name, address, and ZIP code of the recipient. If there are multiple payees with different surnames or if it's for a fiduciary, trust, or estate, be sure to mark the appropriate names with an asterisk (*).

- In the 'Paid By' section, enter your name, address, ZIP code, and identifying number to ensure proper attribution of the reported income.

- Review all entered information for accuracy and completeness. Make any necessary corrections before finalizing the document.

- Once you have completed the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Complete your MO MO-99 MISC form online to ensure accurate reporting of your miscellaneous income.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Usually, you need to earn $600 or more in a calendar year to receive a 1099-MISC. This threshold applies to most types of income, including freelance work, rent payments, and certain prizes. However, there are exceptions, so make sure to confirm with the payer if you have questions. Keeping accurate records of your earnings is crucial for complete tax reporting.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.