Loading

Get Ny Dtf Tp-584.1 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF TP-584.1 online

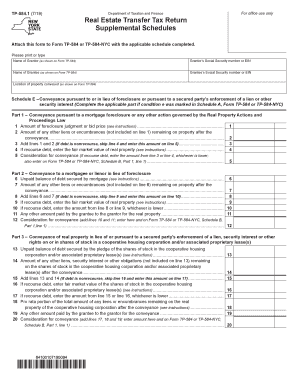

The NY DTF TP-584.1 form is essential for reporting conveyances related to foreclosure situations and secured party enforcement actions. This guide provides step-by-step instructions for completing this form online, ensuring accuracy and compliance with the requirements.

Follow the steps to effectively complete your form online:

- Use the ‘Get Form’ button to access the form digitally in your preferred online editor.

- Begin by entering the names of the grantor and grantee, matching exactly with Form TP-584. Include the corresponding Social Security number or Employer Identification Number for both parties.

- Input the location of the property being conveyed, ensuring it aligns with the detail provided in Form TP-584.

- Proceed to complete Schedule E if applicable, noting any conveyance due to foreclosure. Fill out the necessary lines regarding the foreclosure judgment or bid price, along with any outstanding liens.

- Continue to part each section of Schedule E, including relevant figures based on the stated instructions, ensuring to address recourse or nonrecourse debt appropriately.

- If needed, complete Schedule F, which pertains to changes in ownership identity or form. Be sure to determine the fair market value and the appropriate percentage of interest conveyed.

- Complete Schedule G if claiming a credit for previously paid taxes, detailing the necessary calculations of prior conveyance tax information.

- Review all entered information for accuracy, ensuring all required fields are populated and values are calculated correctly.

- Once satisfied with the content, look for options to save your changes, download the form, or print and share for record-keeping.

Complete your NY DTF TP-584.1 form online to ensure efficient processing and compliance.

Related links form

You can pick up tax forms at local tax offices or government buildings in New York. However, consider checking the New York State Department of Taxation and Finance for downloadable options, such as the NY DTF TP-584.1. This approach saves time and ensures you have the correct forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.