Loading

Get Mo Mo-5090 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-5090 online

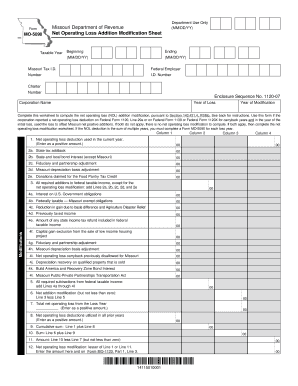

The MO MO-5090 form is essential for corporations seeking to compute the net operating loss addition modification. By following this comprehensive guide, users can easily navigate each section of the online form with clarity and support.

Follow the steps to complete the MO MO-5090 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year in the designated field. Ensure correct dates are provided for both the beginning and ending of the taxable year.

- Input the Missouri Tax Identification Number and the Federal Employer Identification Number in their respective fields.

- Provide the corporation name relevant to the net operating loss and mention the year of loss along with the year of modification.

- In Column 1, Line 1, enter the net operating loss deduction used in the current year as a positive amount.

- For Lines 2a to 2e in Column 2, include all necessary additions from the loss year to federal taxable income except for the net operating loss modification.

- Calculate the total required additions from the loss year and input this total on Line 3 of Column 3.

- Complete Lines 4a to 4l in Column 4 with the required subtractions from federal taxable income for the loss year.

- Sum the values from Lines 4a through 4l and enter this total on Line 5.

- Calculate the net addition modification by subtracting Line 5 from Line 3, and ensure it is not less than zero. Enter this value on Line 6.

- Input the total net operating loss from the loss year in Column 3 and note the tax year of the net operating loss.

- Enter the net operating loss deduction utilized in prior years on Line 8.

- Add Lines 1 and 8 and place the result on Line 9.

- Combine Lines 6 and 9, and write this value on Line 10.

- Subtract Line 7 from Line 10 to yield Line 11, ensuring it is not less than zero.

- Finally, enter the lesser value of Line 1 or Line 11 on Line 12 and include this amount on Form MO-1120, Part 1, Line 3.

- After completing the form, review for accuracy. Save changes, or download, print, or share the form as needed.

Complete the MO MO-5090 online today to ensure compliance with your Missouri tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

A 1040 tax form is used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). This form allows individuals to detail their income, claim deductions, and determine their tax liability. Understanding how to accurately fill out a 1040 is crucial, and resources like the MO MO-5090 can guide you through the process for Missouri taxpayers.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.