Loading

Get Mo Form E-6 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-6 online

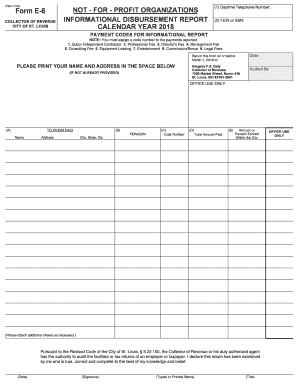

The MO Form E-6 is essential for not-for-profit organizations to report certain payments for the calendar year. This guide will help you navigate the process of filling out this form online with clarity and ease.

Follow the steps to complete the MO Form E-6 online effectively.

- Click the ‘Get Form’ button to access the form and open it in your preferred online platform.

- Complete boxes 1 and 2 with your daytime telephone number and either your Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Ensure the telephone number is valid and reachable during business hours.

- In column A, provide the name and address of the individual or organization to whom payment was made.

- In column B, enter the FEIN or SSN corresponding to each payee listed in column A.

- In column C, assign a code number that best describes the type of payment made, using the specified payment codes.

- In column D, indicate the total amount paid to each listed payee.

- In column E, specify the amount or percentage of the work performed within the City of St. Louis for each payee.

- At the bottom of the form, date and sign the document, and print your name and title clearly.

- Review the completed form for accuracy, ensuring all information is legible, then proceed to save your changes.

- You may download, print, or share the completed form as needed before mailing it to the specified address by the deadline.

Complete your MO Form E-6 online for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 2350 is an application for an extension of time to file your federal income tax return, typically used by U.S. citizens and residents living abroad. This form is relevant for taxpayers who need extra time but still need to ensure they meet all state requirements. If you are navigating both state and federal extensions, include your MO Form E-6 to stay compliant with Missouri tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.