Get Ny Dtf It-201-att 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY DTF IT-201-ATT online

How to fill out and sign NY DTF IT-201-ATT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, a majority of Americans seem to favor preparing their own income taxes and, in addition, to complete reports electronically.

The US Legal Forms online platform facilitates the process of filing the NY DTF IT-201-ATT efficiently and effortlessly.

Ensure that you have filled out and submitted the NY DTF IT-201-ATT accurately and on time. Consider any relevant deadlines. Providing incorrect information in your tax documents could lead to serious penalties and complicate your annual tax return. Always utilize professional templates available through US Legal Forms!

- Launch the PDF template in the editor.

- Examine the highlighted fillable fields. Here you can insert your information.

- Select the option to indicate if you see the checkboxes.

- Explore the Text tool and other advanced features to manually modify the NY DTF IT-201-ATT.

- Verify all the information before proceeding to sign.

- Create your unique eSignature using a keyboard, digital camera, touchpad, mouse, or mobile device.

- Authenticate your online template digitally and record the date.

- Click on Done to continue.

- Store or deliver the file to the intended recipient.

How to modify Get NY DTF IT-201-ATT 2019: personalize documents online

Experience a hassle-free and paperless method of altering Get NY DTF IT-201-ATT 2019. Utilize our reliable online service and conserve a significant amount of time.

Creating every document, including Get NY DTF IT-201-ATT 2019, from the ground up demands excessive effort, so having a proven platform of pre-prepared form templates can greatly enhance your productivity.

However, altering them can be difficult, particularly with files in PDF format. Thankfully, our vast library features an integrated editor that enables you to swiftly complete and modify Get NY DTF IT-201-ATT 2019 without needing to leave our site, thus ensuring you do not waste time processing your documents.

Whether you need to execute editable Get NY DTF IT-201-ATT 2019 or any other document in our collection, you’re on the right track with our online document editor.

It's straightforward and secure and does not require you to possess special skills. Our web-based solution is tailored to manage nearly everything you can imagine regarding file editing and completion. Leave behind the conventional way of handling your documents. Embrace a more productive option to assist you in simplifying your tasks and making them less reliant on paper.

- Step 1. Locate the required form on our website.

- Step 2. Press Get Form to access it in the editor.

- Step 3. Utilize advanced editing tools that let you insert, delete, annotate, and emphasize or redact text.

- Step 4. Create and append a legally-recognized signature to your document using the sign option from the upper toolbar.

- Step 5. If the document's layout doesn't meet your expectations, use the options on the right to eliminate, add, and rearrange pages.

- Step 6. Add fillable fields so that others can be invited to complete the document (if applicable).

- Step 7. Distribute or send the document, print it, or choose the format in which you want to receive the file.

Get form

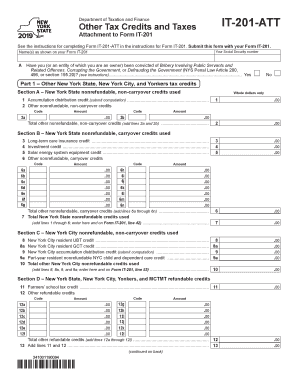

You can obtain New York State income tax forms, including the IT-201-ATT, directly from the official New York Department of Taxation and Finance website. Additionally, large libraries or tax preparation offices usually have printed copies available. For convenience, platforms like uslegalforms also provide resources to access these forms easily.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.