Loading

Get Mo Form E-1r 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-1R online

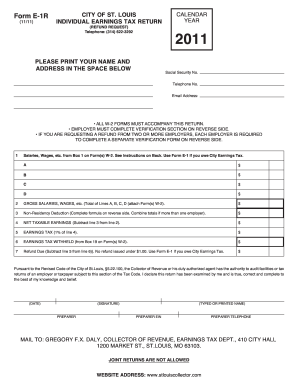

The MO Form E-1R is designed for individuals seeking a refund of the earnings tax for non-residents who worked outside the City of St. Louis. This guide will provide you with step-by-step instructions on how to effectively complete the form online.

Follow the steps to complete your MO Form E-1R.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your full name and address in the designated fields at the top of the form. Also, provide your Social Security number, telephone number, and email address. Ensure all entries are accurate.

- For Line 1, enter the salary or wages detailed in Box 1 of each of your W-2 forms. If you have multiple employers, complete this for each employer's income separately.

- On Line 2, calculate your gross salaries and wages by summing Lines A, B, C, and D. You must attach copies of all W-2 forms to support these figures.

- Complete the non-residency deduction on Line 3 using the provided formula on the reverse side of the form. Be sure to calculate this based on verification from your employer.

- Line 4 requires you to determine your net taxable earnings by subtracting Line 3 from Line 2.

- Calculate the earnings tax owed on Line 5, which is 1% of Line 4.

- Enter the total earnings tax withheld from Box 19 of your W-2s in Line 6.

- For Line 7, calculate your refund due by subtracting Line 5 from Line 6. Note that no refunds will be issued for amounts less than $1.00.

- At the bottom of the form, sign and date your declaration, certifying the accuracy of the information provided. If someone else prepared the form for you, also include the preparer's name, EIN, and telephone number.

- Save your changes to the form, and review it for completeness and accuracy. Finally, you can download, print, or share the document as needed.

Complete your MO Form E-1R online today for a hassle-free refund process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

When filling out an income tax return form, first gather all necessary documents and forms, such as W-2s and 1099s. Next, carefully enter your personal and financial information, ensuring that all amounts are accurate. Review your completed form for any errors before submission, and utilize tools like MO Form E-1R to guide you along the way.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.