Loading

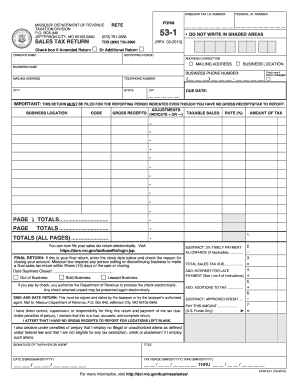

Get Mo Dor Form 53-1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR Form 53-1 online

Filling out the MO DoR Form 53-1 online is a straightforward process that enables users to complete their sales tax return efficiently. This guide provides clear, step-by-step instructions tailored for various users, ensuring that all necessary information is accurately submitted.

Follow the steps to complete your sales tax return.

- Click ‘Get Form’ button to obtain the form and open it for editing. This action will initiate the process of accessing the MO DoR Form 53-1.

- Enter your Missouri Tax I.D. number and Federal I.D. number, ensuring accuracy to prevent delays in processing your return.

- Fill in the owner's name, business name, and the current mailing address where correspondence should be sent.

- Input your business phone number and verify the reporting period for which you are filing.

- If you are making corrections to your address, check the appropriate box and provide the corrected information in the designated fields.

- List each business location under the Business Location column, including any adjustments or nontaxable receipts relevant to those locations.

- Indicate your gross receipts for all sales, stating whether adjustments are applicable and categorizing them as 'plus' or 'minus'.

- Calculate your taxable sales by deriving the sum of gross receipts and adjustments, and enter this amount in the Taxable Sales field.

- Specify the appropriate tax rate for each location, referring to the rate tables if necessary, and calculate the amount of tax due for each entry.

- Complete the total calculations across all pages by summing columns where needed and checking for accuracy.

- Sign and date the return to affirm the accuracy of the document, and ensure it is filed by the due date indicated.

Complete your MO DoR Form 53-1 online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To apply for tax-exempt status in Missouri, you will need to complete the appropriate application forms, which can vary depending on your organization type. Consulting the guidance on the MO DoR Form 53-1 can provide clarity on the process. Additionally, consider seeking assistance from professionals to ensure compliance with state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.