Get Mo 2643a 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 2643A online

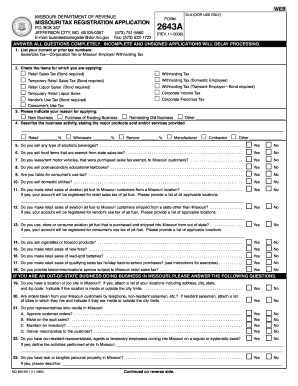

Filling out the MO 2643A, the Missouri Tax Registration Application, online can streamline your business's registration process. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to access the MO 2643A and open it in the online editor.

- In section 1, list your current or prior tax numbers, including Sales/Use Tax and Employer Withholding Tax if applicable.

- In section 2, check all applicable items for which you are applying, ensuring to note if a bond is required for those selections.

- Indicate your reason for applying in section 3, selecting from options such as New Business or Reinstating Old Business.

- Describe your business activities in section 4, specifying the major products sold and services provided.

- Answer all yes/no inquiries in sections 5 through 23 regarding your sales, services, and business operations.

- Fill out the Business Name and Physical Location details in section 24, along with your Federal Employer ID Number in section 25.

- Specify your ownership type in section 27, selecting from options like Sole Owner or Partnership and providing the necessary registration details.

- Complete the Owner Name and Address section, including the Owner's Social Security Number and Birthdate in section 28.

- Address any Previous Owner Information in section 29 if applicable, including the details of the previous business owner.

- Fill out the Business Mailing Address in section 30, ensuring this is the address where reporting forms will be sent.

- Complete sections 33 through 50, which cover sales/use tax and employer withholding tax details, along with bond information.

- Lastly, sign the form in section 51, where the owner or applicable representative must confirm the accuracy of the information.

Complete your MO 2643A online today to ensure timely processing of your tax registration.

Get form

Related links form

To obtain a copy of your Missouri sales tax certificate, you need to request it from the Missouri Department of Revenue. This often requires submitting a formal request along with any pertinent information related to your business. Having a valid sales tax certificate is crucial for compliance and tax collection. If you're unsure about the process, uslegalforms can provide valuable assistance with this and other related forms, including MO 2643A.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.