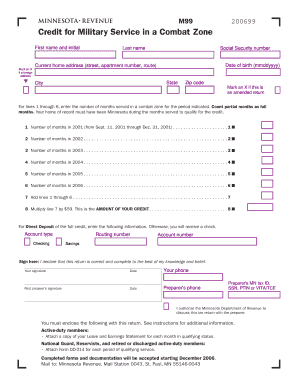

Get Mn M99 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MN M99 online

How to fill out and sign MN M99 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, the majority of Americans typically choose to handle their own income tax filings and, indeed, to fill out forms electronically.

The US Legal Forms online platform facilitates the process of submitting the MN M99 efficiently and conveniently.

Ensure that you have filled out and submitted the MN M99 accurately and on time. Pay attention to any deadlines. Providing incorrect information on your financial documents could lead to significant penalties and cause issues with your annual tax return. Be sure to utilize only official templates from US Legal Forms!

- Launch the PDF document in the editor.

- Observe the highlighted fillable sections. This is where you should enter your information.

- Choose the option to mark if you see the checkboxes.

- Access the Text tool and other advanced functionalities to manually alter the MN M99.

- Double-check all the information before you proceed with signing.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your online template and indicate the specific date.

- Click on Done to proceed.

- Download or forward the document to the recipient.

How to modify Get MN M99 2008: personalize forms online

Take advantage of the user-friendly multi-functional online editor as you work on your Get MN M99 2008. Utilize the variety of tools to swiftly fill in the blanks and present the required information immediately.

Preparing documents can be labor-intensive and costly unless you possess pre-prepared fillable forms that can be completed electronically. The optimal approach to manage the Get MN M99 2008 is by employing our expert and versatile online editing tools. We furnish you with all necessary instruments for rapid document completion and allow you to make any modifications to your forms to meet specific needs. Furthermore, you can append comments on the revisions and leave notes for other involved parties.

Here’s what you can accomplish with your Get MN M99 2008 in our editor:

Handling Get MN M99 2008 in our robust online editor is the quickest and most efficient method to organize, submit, and disseminate your documents as required from anywhere. The tool runs from the cloud, allowing you to access it from any internet-enabled device. All forms you generate or complete are safely stored in the cloud, granting you continuous access and ensuring that you won’t lose them. Stop squandering time on manual document filling and discard papers; conduct everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Sign selections.

- Emphasize crucial details with a chosen color or underline them.

- Hide sensitive information using the Blackout tool or simply delete them.

- Insert images to illustrate your Get MN M99 2008.

- Swap the original text with one that fits your requirements.

- Add comments or sticky notes to update others about the changes.

- Remove unnecessary fillable sections and designate them to specific recipients.

- Secure the document with watermarks, dates, and bates numbers.

- Distribute the document in multiple ways and save it on your device or the cloud in various formats once you finish editing.

Get form

Related links form

You can obtain Minnesota state tax forms online through the Minnesota Department of Revenue website. The site offers easy access to all necessary forms and instructions, making the process user-friendly. For any specific inquiries, refer to the MN M99 guide, which may provide additional insights on tax form requests.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.