Get Mn Dor Ig260 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR IG260 online

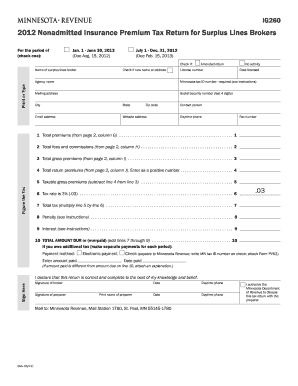

This guide provides a clear and supportive walkthrough for completing the MN DoR IG260, the Nonadmitted Insurance Premium Tax Return for Surplus Lines Brokers. By following these instructions, you can successfully fill out the form online, ensuring compliance with Minnesota's filing requirements.

Follow the steps to complete the MN DoR IG260 online.

- Click the ‘Get Form’ button to access the IG260 document and open it in your online editor.

- Begin by filling out your personal information, including the name of the surplus lines broker, license number, and if applicable, check the box for new name or address. Provide your Minnesota tax ID number, mailing address, and contact details, making sure to enter your daytime phone and email address.

- Complete the premium and fee details on Page 2. Report the total premiums from the columns provided (G, H, I, J) ensuring all values are accurately entered.

- Calculate your taxable gross premiums by subtracting total return premiums from total gross premiums. Enter the result on line 5.

- Determine your total tax by applying the tax rate of 3% to the taxable gross premiums and entering this amount on line 7.

- If applicable, add any penalties or interest to lines 8 and 9, ensuring all values are calculated accurately. Sum totals from lines 7 to 9 and record on line 10 for the total amount due or overpaid.

- Review the form for any errors and ensure all required information is complete. Sign the form, adding the date and the contact details of the preparer if someone else filled it out.

- Once completed, save the form. You may download, print, or share the form as necessary for submission.

Complete the MN DoR IG260 online today to ensure timely filing and compliance.

Get form

Mail from the Revenue Administration Division likely concerns your tax information, audits, or important updates related to state tax regulations. The MN DoR IG260 might be cited in these documents when explaining your obligations or rights. Always consider reaching out to their customer service for any questions or concerns regarding the mail you receive. Additionally, uslegalforms can offer tools and guidance to help you respond effectively to these communications.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.