Get Mi Transfer Of Ownership Guidelines 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Transfer of Ownership Guidelines online

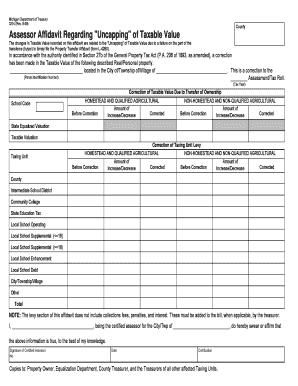

Completing the MI Transfer of Ownership Guidelines is essential for accurately reporting property ownership changes in Michigan. This guide provides clear and concise instructions to facilitate the online completion of this important document, ensuring compliance with state regulations.

Follow the steps to successfully complete the MI Transfer of Ownership Guidelines.

- Click ‘Get Form’ button to obtain the MI Transfer of Ownership Guidelines form and open it in your selected online editor.

- Fill in the 'Background Information' section. Start by providing relevant ownership details, including the names of current and new owners, as well as their addresses.

- In the 'Transfer of Ownership Definitions' section, describe the type of ownership change being reported, referencing applicable regulations outlined in the guidelines.

- Complete the 'Deeds and Land Contracts' segment by detailing the specific deed or contract involved in the transfer, ensuring accuracy for record-keeping and tax assessment purposes.

- Proceed to the 'Ownership Changes of Legal Entities' section if the transfer pertains to a business entity. Provide relevant legal documentation to support the transfer.

- Review any exemptions that may apply under the transfer guidelines, such as transfers between family members or involving charitable organizations, and fill out relevant sections accordingly.

- Check the 'Property Transfer Affidavit' section to ensure that all required notifications are documented and filed according to the Michigan property tax law.

- Once all sections have been completed, save your changes to the form. You may also want to download, print, or share the form for your records.

Complete your document submissions online today to ensure proper transfer of ownership management.

Get form

Related links form

In Michigan, the statute period for adverse possession is 15 years. This means a person must occupy the property openly and continuously for this period to potentially claim ownership. Understanding this timeframe within the context of MI Transfer of Ownership Guidelines is essential for property owners. Resources from uslegalforms can help clarify any complexities surrounding adverse possession claims.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.