Loading

Get Ca Ftb 3520 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3520 online

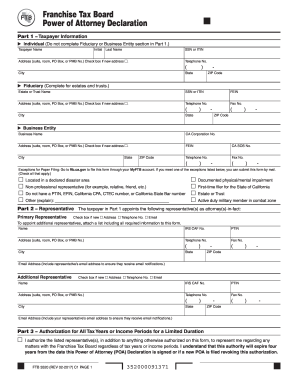

Filling out the California Franchise Tax Board's Power of Attorney Declaration, Form FTB 3520, can seem daunting. This guide aims to walk you through each step of the online process, ensuring you complete the form accurately and efficiently.

Follow the steps to fill out the CA FTB 3520 online correctly.

- Press the ‘Get Form’ button to download and open the form in the editor.

- In Part 1, provide your taxpayer information. If you are an individual, enter your name, Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), address, and telephone number. Ensure this section accurately reflects your personal details.

- Next, select your Power of Attorney filing option by indicating whether you are an individual, fiduciary for estates or trusts, or a business entity.

- In Part 2, list your representative’s information. This involves entering their full name, IRS Central Authorization File (CAF) number, and contact details.

- In Part 3, decide on the duration of your authorization. Check the box to authorize your representative for all tax years or income periods for a limited duration.

- Proceed to Part 4 to specify the tax years or income periods covered by this Power of Attorney declaration. Ensure you list each relevant period accurately.

- In Part 5, indicate any additional privileges you wish to grant your representative, such as signing your tax return or receiving refund checks.

- If you want to retain any prior Power of Attorney declarations, complete Part 6.

- In Part 7, check any applicable nontax issues if relevant. If this form is solely for nontax issues, go to Part 9.

- Complete Part 9 with your signature, ensuring that it matches the name provided in Part 1, and date the declaration.

- After finishing all the sections, you can save your changes, download your completed form, print it, or share it as needed.

Complete your documents online for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain a California Power of Attorney form, you can visit the California Franchise Tax Board's website for the latest version. Additionally, platforms like uslegalforms offer templates that meet state requirements. You can download and fill out the form conveniently, ensuring you have the right documents to manage your legal matters related to the CA FTB 3520.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.