Loading

Get Ca Ftb 3502 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

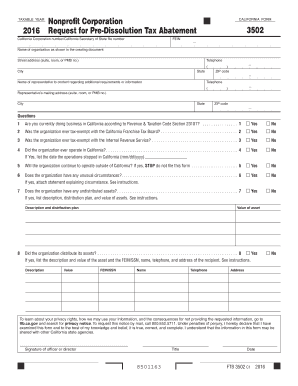

How to fill out the CA FTB 3502 online

Filling out the CA FTB 3502 form can seem daunting, but with clear guidance, you can navigate the process smoothly. This guide will provide detailed instructions to help you complete your form accurately and efficiently.

Follow the steps to fill out the CA FTB 3502 online

- Click the ‘Get Form’ button to access the CA FTB 3502 form online, allowing you to fill it out in an easy-to-use interface.

- In the form, enter the taxable year in the corresponding field. Make sure to input the correct year for which you are requesting the tax abatement.

- Provide your California Corporation number or California Secretary of State file number in the designated area to verify your organization’s identity.

- Fill in your federal employer identification number (FEIN) to ensure proper identification for tax purposes.

- Enter the name of your organization as it appears in your creation documents. This should match the legal name registered with the state.

- Complete the street address section, including any suite, room, or PMB number, city, state, and ZIP code where your organization is located.

- Add a contact telephone number where representatives can reach you regarding any questions about the form.

- Specify the name of the representative to contact for additional requirements or information, along with their telephone number and mailing address.

- Answer the series of yes/no questions regarding your organization's business activity status, tax exemption history, and asset distribution. Provide additional information as required, including dates and descriptions.

- Sign and date the form in the indicated area, ensuring that the signature belongs to an officer or director of the organization.

- Review all entries for accuracy and completeness before submitting. Save changes, download, print, or share the completed form as necessary.

Complete your CA FTB 3502 form online today and ensure your organization meets its tax obligations!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Receiving a letter from the FTB can indicate various issues, such as a pending tax return or an inquiry about your tax records. It’s essential to read the letter carefully and respond promptly to avoid any complications. Utilizing the services of platforms like uslegalforms can help you understand and address the concerns outlined in the letter.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.