Loading

Get Il Amusement Exemption Application - Cook County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL Amusement Exemption Application - Cook County online

Filling out the IL Amusement Exemption Application online can be a straightforward process when guided step-by-step. This application is essential for obtaining an exemption from amusement taxes in Cook County, making it crucial for event organizers to understand and accurately complete it.

Follow the steps to successfully complete the application.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

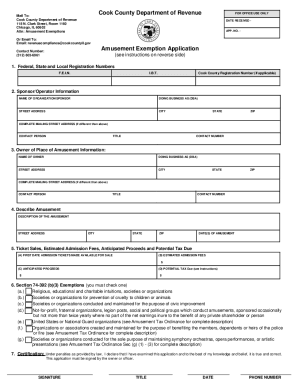

- Fill in the federal, state, and local registration numbers in the designated fields. This includes your Federal Employer Identification Number (F.E.I.N), Illinois Business Tax Number (I.B.T.N.), and Cook County Registration Number if applicable.

- Provide detailed information about the sponsor or operator of the amusement. Include the name of the organization, doing business as (DBA), street address, city, state, zip code, and contact person with their title and phone number.

- Enter the owner's information of the place where the amusement will be held. This section demands the owner’s name, DBA, address details similar to the previous step, and contact information.

- Describe the amusement in detail, including the address, city, state, zip code, and the date(s) of the event.

- Estimate and provide details related to ticket sales. Specify the first date tickets are made available for sale, the estimated admission fees, anticipated proceeds, and the potential tax due calculated at a rate of 3% of the estimated admission fees.

- Select one applicable exemption type from Section 74-392 (b)(3) and check the corresponding box, ensuring it corresponds to the nature of the organization.

- Complete the certification section at the bottom of the form, ensuring to provide the signature, title, date, and phone number of the individual responsible for the application.

- Review all entries carefully to ensure all information is accurate and complete. Incomplete applications may be rejected.

- Once complete, save your changes, and download or print the application for your records. You may also share the completed form as necessary.

Ensure your exemption application is submitted accurately and on time by completing the document online today.

Related links form

The city venue tax in Chicago applies to tickets sold for entertainment events at various venues within the city. This tax helps fund city operations and cultural programs. For better clarity on your responsibilities and possible exemptions, you may want to explore the IL Amusement Exemption Application - Cook County.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.