Loading

Get Md Sdat Form 4a 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD SDAT Form 4A online

Filling out the MD SDAT Form 4A online is a straightforward process that requires careful attention to detail. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete the MD SDAT Form 4A online.

- Select the ‘Get Form’ button to access the document and open it in your online form editor.

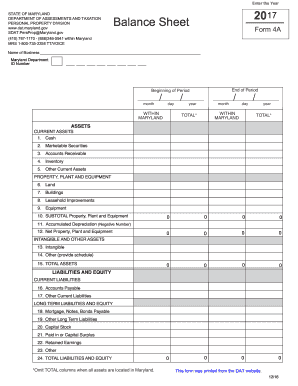

- Begin by entering the year for which you are reporting at the top of the form, indicated as 'Enter the Year'.

- Fill in the name of the business and the Maryland Department ID number in the designated fields to ensure proper identification.

- Record the beginning and end period dates for the reporting year. This includes the month, day, and year in the respective fields.

- In the 'Assets' section, fill out the details of current assets, including cash, marketable securities, accounts receivable, inventory, and other current assets.

- Proceed to the 'Property, Plant and Equipment' section. Fill in each asset category, including land, buildings, leasehold improvements, machinery, and total these amounts.

- Calculate and enter the accumulated depreciation, ensuring that any negative values are noted as such.

- Complete the 'Liabilities and Equity' section. Document any current and long-term liabilities, including accounts payable and mortgages.

- Finally, after reviewing all entries for accuracy, you can save your changes, download the completed form, print a copy for your records, or share it as needed.

Complete the MD SDAT Form 4A online today to stay compliant and organized.

Related links form

To file an amended tax return in Maryland, you need to submit the appropriate forms to correct any errors from your original return. This process includes using the MD SDAT Form 4A if it relates to personal property. Be sure to include the explanation for the changes and any supporting documentation. Filing an amendment promptly can help you ensure your tax situation is accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.