Loading

Get Md Form Met 2 Adj 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form MET 2 ADJ online

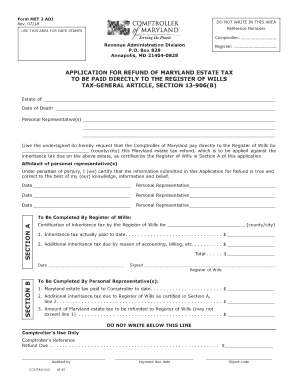

Filling out the MD Form MET 2 ADJ is an essential process for requesting a refund of the Maryland estate tax. This guide will provide you with detailed instructions to help you navigate through the form effectively, ensuring that all necessary information is accurately submitted.

Follow the steps to complete the MD Form MET 2 ADJ easily.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the estate name in the designated field. Make sure to include the full legal name for accuracy.

- Input the date of death of the deceased in the corresponding field. This date is critical for processing the claim.

- List the personal representatives' names in the provided space. This section requires the names of all individuals responsible for managing the estate.

- Complete the request section indicating the county or city for where the refund is to be paid. This ensures that the funds are directed appropriately.

- In the first section for personal representatives, indicate the total Maryland estate tax paid to date, making sure to provide an accurate dollar amount.

- Next, detail any additional inheritance tax due as certified in Section A. This allows for transparency and proper calculation of the refund.

- Specify the amount of Maryland estate tax to be refunded to the Register of Wills. Remember, this amount should not exceed the total estate tax paid.

- Carefully review all the entries to confirm their accuracy before finalizing. It's crucial to ensure that no errors are present to avoid processing delays.

- Once all information is complete and verified, save your changes. You can then download, print, or share the completed MD Form MET 2 ADJ as necessary.

Complete your MD Form MET 2 ADJ online today and ensure your estate tax refund is processed promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Tax exemptions for 2025 will often include adjustments for inflation and can differ by category. It is important to stay updated on both federal and state tax policies. Utilizing a tool like the MD Form MET 2 ADJ can help individuals navigate and leverage these exemptions effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.