Get Md Form 548 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Form 548 online

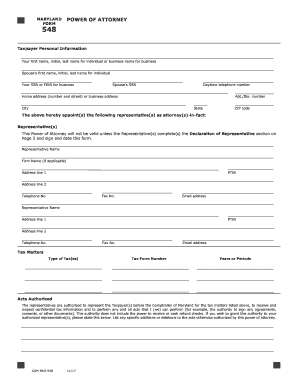

Filling out the MD Form 548, Power of Attorney, is an important step in appointing a representative for tax matters in Maryland. This guide provides clear instructions on how to complete the form online, ensuring all relevant information is accurately captured.

Follow the steps to complete the MD Form 548 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the taxpayer personal information section, including your first name, middle initial, last name, or the business name if applicable. Also, enter your spouse's first name, middle initial, last name, and their Social Security Number (SSN) or Federal Employer Identification Number (FEIN). Don't forget to provide your daytime telephone number and the home or business address, including city, state, and ZIP code.

- In the section titled 'Representative(s)', appoint your representative(s) by providing their full name, firm name (if applicable), and contact information such as address, PTIN, telephone number, fax number, and email address.

- Specify the tax matters for which the representative is authorized, including the type of tax, relevant tax form numbers, and applicable years or periods.

- Review the acts authorized section to ensure your representative can perform all necessary acts regarding tax matters, while noting that the authority does not include the ability to receive or cash refund checks unless explicitly stated.

- Complete the retention/termination of prior powers of attorney section, ensuring that you mark if previous powers are to be revoked and attach necessary documentation.

- Sign and date the form in the taxpayer’s signature section. If applicable, include the spouse's signature as well, as both signatures are required for joint representations.

- The representative must complete and sign the declaration of representative section, affirming their qualifications and the authority to represent.

- Finally, ensure all sections of the form have been completed as an incomplete MD Form 548 will not be processed. Save changes, download, or print the completed form for your records.

Complete your MD Form 548 online today for effective document management.

Get form

Related links form

You should mail MD estimated tax payments to the address specified by the Maryland Comptroller’s office, depending on your payment method. Typically, payments made with a check must include the appropriate forms, such as the MD Form 548 for reporting non-resident income. Ensuring that you send your payment to the correct address helps avoid delays and penalties. To ensure accuracy, it might be helpful to reference resources from US Legal Forms during this process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.