Loading

Get Irs 1040 Lines 16a And 16b 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Lines 16a and 16b online

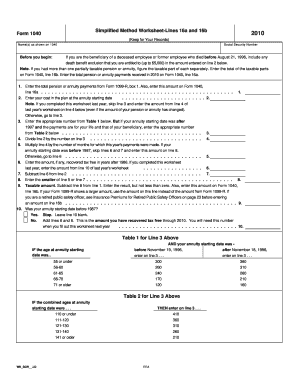

This guide provides a clear and supportive approach to filling out the IRS 1040 Lines 16a and 16b online. Understanding these lines is crucial for accurately reporting your pension and annuity payments, ensuring compliance with tax regulations.

Follow the steps to accurately complete your IRS 1040 Lines 16a and 16b.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your name(s) as shown on Form 1040 and your Social Security number in the appropriate fields.

- On line 1, input the total pension or annuity payments received during the tax year from Form 1099-R, box 1. Also, make sure this amount matches with what you enter on line 16a of Form 1040.

- For line 2, input your cost in the plan at the annuity starting date.

- If applicable, skip line 3 if you completed this worksheet last year and directly enter the amount from line 4 of last year's worksheet on line 4. If not, enter the appropriate number from the provided tables based on your annuity starting date on line 3.

- Divide the amount on line 2 by the number on line 3 and enter the result on line 4.

- Multiply the amount on line 4 by the number of months for which payments were made this year. If your annuity starting date was before 1987, skip lines 6 and 7.

- If necessary, enter any amounts recovered tax-free in years after 1986 on line 6. If you completed the worksheet last year, enter the amount from line 10 of last year's worksheet.

- Subtract the amount from line 6 from line 2 and enter the result on line 7.

- On line 8, enter the smaller of line 5 or line 7.

- For line 9, calculate the taxable amount by subtracting line 8 from line 1. If this result is less than zero, enter zero. Enter this final amount on line 16b of Form 1040.

- If your annuity starting date was before 1987, leave line 10 blank. If it was after, add lines 6 and 8 for future reference.

- After filling out the necessary fields, save your changes, download, print, or share the form as needed.

Complete your IRS 1040 Lines 16a and 16b online today for accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Income From Pensions, Annuities, Interest, And Dividends Pension payments, annuities, and the interest or dividends from your savings and investments are not earnings for Social Security purposes. Only earned income, your wages, or net income from self-employment, is covered by Social Security.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.