Loading

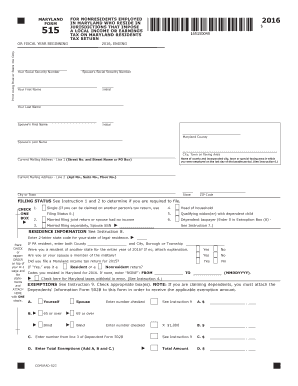

Get Md Comptroller 515 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 515 online

This guide provides clear and comprehensive instructions for completing the MD Comptroller 515 form online. Users will find step-by-step guidance to navigate each section and field of the form efficiently.

Follow the steps to complete the MD Comptroller 515 form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Fill in the tax year section by entering the relevant fiscal year at the top of the form.

- Enter your Social Security number in the designated field, followed by your spouse's Social Security number if applicable.

- Input your first and last name, as well as your spouse's name if filing jointly, in the corresponding fields.

- Provide your current mailing address, ensuring to fill in all parts, including city, state, and ZIP code.

- Select your filing status by checking the appropriate box based on your situation.

- Fill in your residence information, including the state code for your legal residence and local tax details if applicable.

- Complete the exemptions section by checking the boxes that apply to you and total the exemptions at the end of this section.

- Report your income in the 'Income and Adjustments Information' section, ensuring all income streams are accurately categorized.

- Proceed to complete any necessary additions or subtractions from income as provided in the instructions.

- Choose between the standard deduction and itemized deduction, providing the necessary amounts as instructed.

- Calculate your taxable net income and ensure it is accurately reflected on the form.

- Complete the Maryland tax computation by utilizing the relevant tax tables based on your taxable income.

- Enter any local tax computations and ensure all required calculations are accurately detailed.

- Review all calculated fields for accuracy, double-checking your entries.

- Once complete, save your changes, then download, print, or share the finalized form as necessary.

Complete your MD Comptroller 515 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file a complaint with the Maryland Comptroller, visit their official website which contains all the necessary forms and instructions. You may need to provide details about your complaint along with your contact information. Additionally, consider checking the FAQs on their site for any related concerns. If you’re unsure about the process, US Legal Forms can help you navigate filing your complaint accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.