Loading

Get Md Comptroller 502x 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller 502X online

This guide provides a comprehensive overview of the MD Comptroller 502X form and detailed instructions to assist users in successfully completing it online. Follow these steps for a clear and efficient filing process.

Follow the steps to efficiently fill out the form.

- Press the ‘Get Form’ button to access the MD Comptroller 502X and open it.

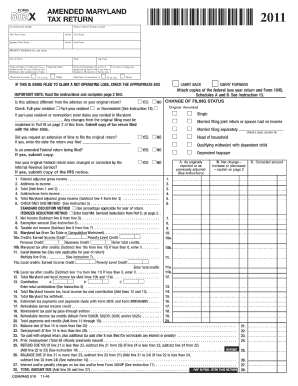

- Fill in your Social Security Number and your spouse's Social Security Number if applicable. Ensure that all names are entered as they appear on the original return.

- Provide your present address, including city or town, state, and ZIP code. If you have moved since filing your original return, please ensure you check the box indicating your address is different.

- Select the box if you or your spouse is 65 or older or blind. This is necessary to determine eligibility for certain tax credits.

- Indicate if you are filing to claim a net operating loss by checking the appropriate box for carry back or carry forward.

- Choose your residency status: full-year resident, part-year resident, or nonresident. Fill in the applicable dates for part-year resident or nonresident status.

- Specify your original and amended filing status. Make sure to check the box next to your current status.

- Answer the questions regarding whether you requested an extension for filing your original return and whether an amended federal return is being filed.

- Complete the income and adjustments section by filling in the necessary fields for federal adjusted gross income, additions to income, and subtractions from income.

- For calculating deductions, select either the standard deduction method or itemized deduction method and complete the required fields.

- Enter all applicable credits and calculate total payments and tax owed or overpayment.

- Once all sections are thoroughly completed, review all entered information for accuracy.

- Save your changes, download, print, or share your completed MD Comptroller 502X form as necessary.

Complete your MD Comptroller 502X online today for accurate and efficient tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out a withholding allowance form involves entering your details, including allowances claimed and personal information. The information determines how much tax will be withheld from your paycheck, impacting your tax return. For further assistance and templates that guide you through this process, US Legal Forms has helpful resources to support you.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.