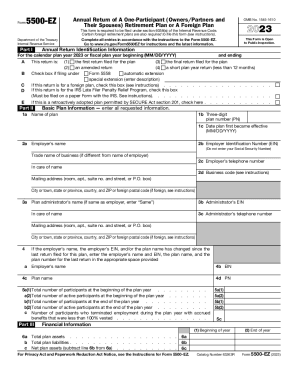

Get Irs 5500-ez 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out and sign a form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:When people aren?t associated with document managing and law processes, filling out IRS documents can be extremely tiring. We comprehend the importance of correctly completing documents. Our platform offers the key to make the process of filing IRS docs as elementary as possible. Follow these guidelines to accurately and quickly fill in IRS 5500-EZ.

How to submit the IRS 5500-EZ online:

-

Click on the button Get Form to open it and begin editing.

-

Fill in all required lines in the selected doc utilizing our convenient PDF editor. Switch the Wizard Tool on to complete the procedure even simpler.

-

Check the correctness of filled details.

-

Add the date of submitting IRS 5500-EZ. Make use of the Sign Tool to create an exclusive signature for the record legalization.

-

Complete editing by clicking Done.

-

Send this record straight to the IRS in the most convenient way for you: via e-mail, using digital fax or postal service.

-

You are able to print it on paper when a copy is needed and download or save it to the preferred cloud storage.

Utilizing our platform will make skilled filling IRS 5500-EZ a reality. We will make everything for your comfortable and easy work.

An employer can apply for an automatic 2 ½ month extension of time to file their Form 5500 by filing a Form 5558 (extending the filing deadline to October 15 for calendar-year plans). The Form 5558 must be filed before the due date of the Form 5500.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.