Get Ma Substitute W-9 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Substitute W-9 online

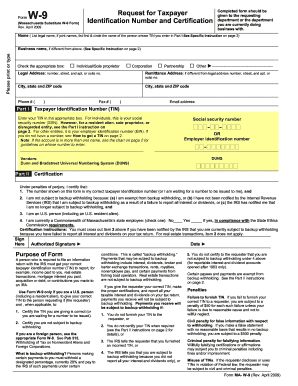

The Massachusetts Substitute W-9 form is crucial for individuals and entities to provide their taxpayer identification number to the requesting department. This guide aims to assist users in filling out the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to complete the MA Substitute W-9 form online.

- Click the ‘Get Form’ button to access the form and open it for editing.

- Enter your legal name in the designated field. If there are joint names, list the first name and circle the name of the individual whose TIN will be provided in Part I.

- If your business name is different from your legal name, enter it in the specified section.

- Check the appropriate box to identify your status: Individual/Sole proprietor, Corporation, Partnership, or Other.

- Fill in your legal address, including the street number, apt/suite number, city, state, and ZIP code.

- Provide your remittance address if it differs from your legal address, ensuring that all relevant details are filled.

- Enter your phone number and fax number if applicable, along with your email address.

- In Part I, enter your Taxpayer Identification Number (TIN). For individuals, this is your Social Security Number (SSN); for entities, it is your Employer Identification Number (EIN). If you do not have a TIN, see instructions for obtaining one.

- Complete Part II, certifying your TIN correctness, confirming you are not subject to backup withholding, and indicating if you are a Commonwealth of Massachusetts state employee.

- After reviewing all entries for accuracy, sign and date the form to certify its contents.

- Save your changes, and proceed to download, print, or share the completed form as necessary.

Start filling out the MA Substitute W-9 online today to ensure compliance and accurate reporting.

Refusing to fill out a W9 can have consequences, especially in terms of taxation and compliance. Without this form, businesses may withhold taxes from your payments, leading to a larger tax burden for you later. Moreover, it can create complications in your business relationships, as many companies require a W9 to fulfill their own reporting obligations. To avoid these issues, consider utilizing a resource like uslegalforms to simplify the completion of a MA Substitute W-9.

Fill MA Substitute W-9

Check only one box on line 3. If you use a substitute form, you are required to provide the Form W9 instructions to the payee only if he or she requests them. This form is used to request a certified copy of a birth certificate from the Clerk of Court Office. (Revised April 2022). Massachusetts. Instructions for the Requester of Form W-9. Also see Special rules for partnerships on page 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and. Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS. This document is the Massachusetts Substitute W-9 form, which allows individuals and entities to provide their taxpayer identification number to the requester. 9. (Massachusetts Substitute 9.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.