Loading

Get Ma St-7r 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA ST-7R online

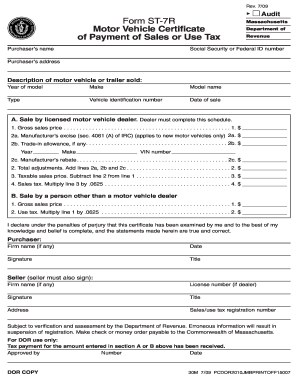

The MA ST-7R form is essential for documenting the payment of sales or use tax for motor vehicle transactions in Massachusetts. This guide will provide you with clear, step-by-step instructions on how to complete this form online.

Follow the steps to complete the MA ST-7R form online

- Click the 'Get Form' button to access the MA ST-7R form online.

- Enter the purchaser's name and their social security or federal ID number in the designated fields.

- Fill in the purchaser's address accurately to ensure proper processing of the form.

- Provide a detailed description of the motor vehicle or trailer being sold, including its year, make, model name, type, and vehicle identification number.

- Indicate the date of sale in the specified section.

- If the sale is made by a licensed motor vehicle dealer, complete section A. Enter the gross sales price on line 1 and any applicable adjustments in lines 2a, 2b (including trade-in allowance), and 2c (rebates).

- Calculate the total adjustments by adding lines 2a, 2b, and 2c, and place the total on line 2.

- Determine the taxable sales price by subtracting line 2 from line 1, and write this amount on line 3.

- Calculate the sales tax by multiplying the taxable sales price on line 3 by 0.0625 and place this value on line 4.

- If the sale is by a person other than a dealer, complete section B. Fill in the gross sales price on line 1 and calculate the use tax by multiplying this amount by 0.0625 for line 2.

- Both purchaser and seller must sign the form. Place all necessary signatures and titles in the designated sections.

- After reviewing all entered information for accuracy, you may save the changes, download the completed form, print it, or share it as needed.

Ready to complete your MA ST-7R form online? Start now for a straightforward filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The safe harbor method for Massachusetts taxes allows taxpayers to avoid penalties for underpayment of estimated tax. Essentially, if you meet certain criteria, you can reduce your tax burden without fear of sanctions. This method is particularly beneficial in managing your tax responsibilities efficiently. Remember, you can always refer to the MA ST-7R for detailed guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.