Loading

Get Ma St-10 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA ST-10 online

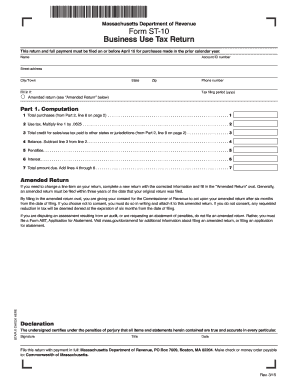

The MA ST-10 is a business use tax return that helps businesses report and pay taxes on purchases made in the previous calendar year. This guide will provide you with step-by-step instructions on how to fill out the form accurately and efficiently, ensuring compliance with Massachusetts tax regulations.

Follow the steps to complete the MA ST-10 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name, account ID number, street address, city or town, state, zip code, and phone number in the appropriate fields.

- Indicate the tax filing period by entering the year in the designated field. If this is an amended return, check the corresponding box.

- Calculate your use tax by multiplying the amount in line 1 by 0.0625 and enter the result in line 12.

- If you have any credits for sales or use tax paid to other jurisdictions, record that total in line 13, which you gathered from Part 2, line 9.

- Subtract the amount in line 3 from the amount in line 2 to find your balance and enter that amount in line 14.

- If applicable, enter any penalties in line 15 and interest in line 16, then calculate your total amount due by adding lines 4 through 6, placing the result in line 17.

- If you're filing an amended return, follow the instructions provided for amendments. Complete a new return with the corrected information and fill in the ‘Amended Return’ oval.

- Finally, review all entries for accuracy. Once finalized, save your changes, then download or print the completed form for submission.

Complete your MA ST-10 document online with confidence and ensure your tax obligations are met.

You file your Massachusetts tax return with the Massachusetts Department of Revenue. This can be done online or by mailing in a paper return. The department's website provides all the necessary resources and forms, including any updates. For an easier experience, USLegalForms can assist you in preparing and submitting your tax return accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.