Loading

Get Ma Schedule C 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Schedule C online

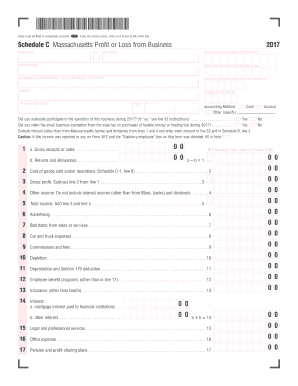

Filling out the MA Schedule C online is an essential step for individuals reporting profit or loss from their business activities in Massachusetts. This guide provides clear instructions to help you navigate each section of the form efficiently.

Follow the steps to successfully complete your MA Schedule C online.

- Press the ‘Get Form’ button to acquire the form and open it in the editing tool.

- Fill in your first name, middle initial, last name, and Social Security number in the designated fields. Provide your business name along with the Employer Identification Number if applicable.

- Indicate your main business or profession, including a brief description of the products or services offered. Additionally, enter the Principal Business Code from the U.S. Schedule C.

- Complete your business address, including city/town, state, and ZIP+4 code. This information is vital for correspondence and verification.

- Select your accounting method by checking the appropriate box for 'Cash' or 'Accrual' or writing 'Other' if applicable.

- Answer the question regarding material participation in the business with a 'Yes' or 'No'. If 'No', make sure to follow the specific instructions related to line 33.

- If you claimed the small business exemption for sales tax on energy during the year, indicate 'Yes' or 'No'.

- Provide details for gross receipts or sales in line 1a and returns and allowances in line 1b. Subtract line 2 (cost of goods sold) from line 1 to calculate your gross profit (line 3).

- List other income sources in line 4 and add them to your gross profit for total income in line 5.

- Complete the various expense fields from lines 6 to 26, carefully entering amounts for advertising, bad debts, vehicle expenses, and other business-related costs.

- Subtract total expenses (line 27) from total income (line 5) to find your tentative profit or loss (line 28).

- If applicable, fill in the amount for expenses for the business use of your home (line 29) and the Abandoned Building Renovation Deduction (line 30).

- Calculate your net profit or loss on line 31 by subtracting lines 29 and 30 from line 28. Enter your profit or loss as directed.

- For any interest or dividends, respond to line 32 as required and fill in line 33 to describe your investment condition if reporting a loss.

- After completing all the required fields, make sure to save your changes. You may then download, print, or share the completed form as needed.

Start completing your MA Schedule C online today to ensure accurate and efficient reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can confirm if your business is a MA Schedule C by evaluating your structure. If you operate as a sole proprietor and earn income directly from your business activities, you must report this income on a Schedule C. If you have a different business structure, such as an LLC, your reporting requirements may differ.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.