Loading

Get Ma Form 3 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form 3 online

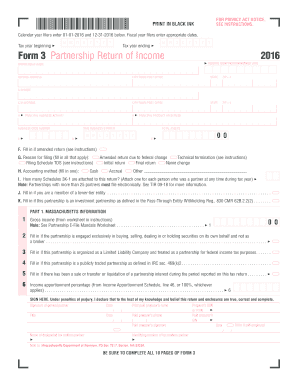

Filling out the MA Form 3 online is a straightforward process. This guide provides detailed instructions to ensure that you complete each section accurately, enabling you to submit your partnership return of income with confidence.

Follow the steps to fill out the MA Form 3 online accurately.

- Press the ‘Get Form’ button to download the form and open it in your editor.

- Enter the tax year by specifying the beginning and ending dates for the calendar year or fiscal year as applicable.

- Fill in the federal identification number (FID) for the partnership in the designated field.

- Provide the full partnership name, mailing address, city or town, state, and ZIP code, ensuring all information is accurate.

- Indicate the principal product or service along with the business activity code number related to the partnership.

- Specify the date the business started and enter total assets as required.

- Check the appropriate boxes for any amendments or reasons for filing, such as an amended return due to federal changes or a name change.

- Enter the accounting method used: cash, accrual, or other.

- Attach the number of Schedules 3K-1 that are relevant for the reporting period.

- Review all sections carefully and ensure you provide any additional information as prompted, such as if the partnership is an investment partnership.

- Sign and date the form as required, ensuring accuracy in the declaration under penalties of perjury.

- Once all sections are completed, you can save your changes, download, print, or share the form as necessary.

Complete your MA Form 3 online with the provided steps to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The mailing address for your MA tax form can vary depending on the specific type of form you are filing. For MA Form 3, refer to the relevant section on the Massachusetts Department of Revenue's official site for the correct address. Properly directing your forms is vital for timely processing. If you're using the uslegalforms platform, it can guide you through the process, making it easier to file correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.