Get Ca Ftb 199 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 199 online

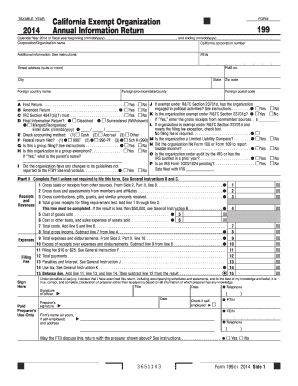

The CA FTB 199 is the California Exempt Organization Annual Information Return, which nonprofits must file to report their financial activities. This guide provides a clear, step-by-step approach to assist users in filling out the form online accurately and efficiently.

Follow the steps to complete the CA FTB 199 online.

- Click ‘Get Form’ button to obtain the CA FTB 199 and open it in the editor.

- Begin by entering the taxable year in the designated field, specifying whether it is the calendar year or a fiscal year.

- Provide the corporation or organization name, including the California corporation number and the Federal Employer Identification Number (FEIN). Complete the street address and zip code or applicable foreign address if outside the U.S.

- Indicate whether this is the first return, an amended return, or pertains to an IRC Section 4947(a)(1) trust by checking the appropriate boxes in section A through D.

- In section E, select the accounting method employed by the organization: cash, accrual, or other.

- State whether a federal return (Form 990T, 990-PF, or Schedule H) has been filed in section F.

- Specify if this is a group filing and if the organization is part of a group exemption in sections G and H.

- Denote any changes to the organization's guidelines not reported to the Franchise Tax Board in section I.

- Complete either Part I or Part II, depending on the organization's gross receipts. Report gross sales, dues from members, contributions, and other income as specified.

- Fill in total expenses and disbursements on Part II, ensuring all financial activities are accurately documented.

- Provide necessary signatures in the Sign Here section, including the date, title, and telephone number of the signing officer.

- Review all provided information for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your CA FTB 199 online today to ensure compliance and maintain your exempt status.

Get form

Related links form

Yes, many tax forms, including CA FTB 199, can be filed online, significantly streamlining the submission process. Electronic filing not only saves time but also reduces errors that can occur with paper submissions. It is important to use legitimate platforms for filing to ensure your information stays safe. Consider US Legal Forms for reliable e-filing services that simplify the process for you.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.