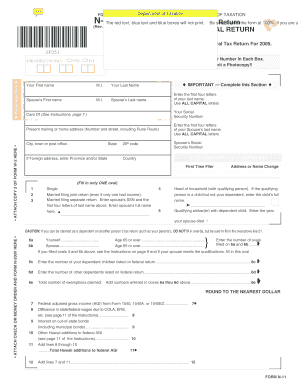

Get Hi N-11 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI N-11 online

How to fill out and sign HI N-11 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all necessary tax forms, such as HI N-11, is the sole responsibility of a US citizen.

US Legal Forms simplifies your tax administration significantly and accurately.

Store your HI N-11 securely. Ensure that all your relevant documents and information are organized while remembering the deadlines and tax regulations established by the Internal Revenue Service. Simplify the process with US Legal Forms!

- Obtain HI N-11 in your internet browser from your device.

- Access the editable PDF file with a click.

- Begin filling out the form field by field, following the instructions of the advanced PDF editor's interface.

- Accurately enter text and figures.

- Choose the Date field to automatically insert today's date or modify it manually.

- Utilize the Signature Wizard to create your custom e-signature and sign in minutes.

- Refer to the IRS guidelines if you have further questions.

- Click Done to finalize the changes.

- Continue to print the document, save it, or share it via Email, text message, Fax, or USPS without leaving your internet browser.

How to modify Get HI N-11 2005: personalize documents online

Choose a reliable document modification solution you can rely on. Alter, execute, and validate Get HI N-11 2005 securely online.

Frequently, modifying documents like Get HI N-11 2005 can be challenging, particularly if you obtained them online or through email but lack specialized tools. While some alternatives exist to navigate this issue, you risk creating a form that does not fulfill the submission criteria. Using a printer and scanner is also not feasible as it consumes time and resources.

We offer a more straightforward and effective approach to completing documents. A comprehensive selection of document templates that are simple to personalize and validate, and then make fillable for others. Our platform goes far beyond just a collection of templates. One of the most significant advantages of utilizing our services is that you can modify Get HI N-11 2005 directly on our platform.

Being an online service means you don’t have to download any software. Furthermore, not all company policies permit downloading it on your work computer. Here’s the optimal method to effortlessly and securely manage your paperwork with our solution.

Bid farewell to paper and other inefficient methods of processing your Get HI N-11 2005 or other documents. Opt for our tool that boasts one of the most extensive libraries of editable forms and robust document modification services. It’s simple and secure, and can save you significant time! Don’t just take our word for it; experience it for yourself!

- Click the Get Form > and you will be instantly taken to our editor.

- Once opened, you can commence the editing procedure.

- Choose checkmark or circle, line, arrow, and cross among other options to annotate your document.

- Select the date field to add a specific date to your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to integrate fillable fields.

- Select Sign from the top toolbar to create and include your legally-binding signature.

- Click DONE to save, print, share or acquire the document.

Get form

Related links form

For an income of $200,000 in Hawaii, after tax deductions, you can expect to keep around $130,000 to $150,000. The exact figure can vary based on specific tax circumstances and deductions. Thus, it is vital to remain informed and utilize resources like the HI N-11 form for your calculations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.