Loading

Get Ldr R-540ins 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LDR R-540INS online

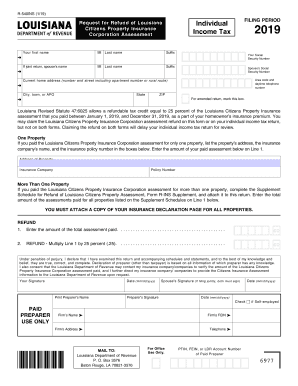

The LDR R-540INS form is used to request a refund of the Louisiana Citizens Property Insurance Corporation assessment for the tax year 2019. This guide provides a comprehensive step-by-step approach to assist users in accurately completing the form online.

Follow the steps to successfully complete the LDR R-540INS form.

- Press the ‘Get Form’ button to access the LDR R-540INS form and open it in your online editor.

- Fill out your personal information, including your first name, middle initial, last name, and suffix. If filing a joint return, include your spouse's name, middle initial, last name, and suffix as well.

- Enter your Social Security Number and your spouse's Social Security Number if applicable. Make sure to include your area code and daytime telephone number.

- Provide your current home address, including the number and street, apartment number, city, state, and ZIP code.

- If you are filing an amended return, mark the appropriate box on the form.

- In the section related to the Louisiana Citizens Property Insurance, indicate if you paid the assessment for one property or multiple properties. If for one property, complete the related fields for the property address, insurance company, and policy number.

- If you paid the assessment for more than one property, complete the attached Supplement Schedule for Refund and enter the total assessment amount on Line 1.

- Calculate your refund by entering the total assessment paid on Line 1 and multiplying it by 25 percent, then entering this value on Line 2.

- Sign and date the form at the designated sections. If applicable, your spouse must also sign if filing jointly.

- Include the paid preparer's information if the return was prepared by someone other than yourself, ensuring they sign as well.

- Finally, review the completed form for accuracy, and then download, print, or share it as needed for submission.

Complete your LDR R-540INS form online today for a smooth filing process.

To write a TDS declaration form, begin with your personal details, including your name, address, and identification number. Then, clearly state the amount of TDS applicable on your income to provide transparency. Be sure to review your declaration for accuracy, as mistakes can lead to complications during tax assessments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.