Get Ks Instructions To Garnishee 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS Instructions to Garnishee online

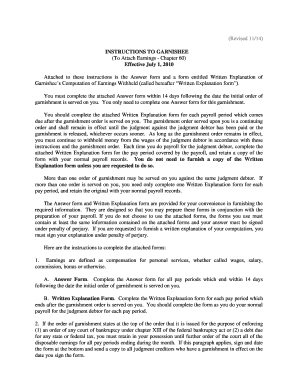

This guide provides a clear, step-by-step approach to completing the KS Instructions to Garnishee form online. Designed to assist users with varying levels of legal experience, this resource aims to simplify the process of managing garnishment orders efficiently and accurately.

Follow the steps to complete the KS Instructions to Garnishee online.

- Press the ‘Get Form’ button to access the form and open it in your chosen online editor.

- Read the garnishment order thoroughly to understand the specifics of the order being served.

- Complete the Answer form for all pay periods ending within 14 days following the service of the initial garnishment order. Ensure you retain a copy for your records.

- For each pay period after the service of the garnishment order, fill out the Written Explanation form according to your regular payroll process for the judgment debtor.

- If the garnishment pertains to enforcing a court order for child support or spousal support, retain 50% or the specified greater percentage of disposable earnings as per the guidelines.

- Calculate the amount of earnings to be withheld based on the disposable earnings table provided, ensuring you follow the specified percentages.

- Complete paragraph 15 of the Answer form by listing the case number, name, and address of all judgment creditors with a garnishment order in effect against the judgment debtor.

- Sign and date the Answer form under penalty of perjury before submitting it to all judgment creditors listed.

- Continue to pay the earnings withheld to the judgment creditors as indicated on the Answer form, unless directed otherwise by a court order.

- If you receive an objection to your Answer within 14 days, address the objection accordingly before making any payments.

Complete your KS Instructions to Garnishee online today for efficient management of garnishment orders.

Related links form

The best way to stop a garnishment involves understanding your legal rights and options. You can either negotiate with the creditor or file a claim of exemption based on your financial situation. Seeking professional assistance, such as using platforms like uslegalforms, can help you navigate the complexities involved. Reviewing the KS Instructions to Garnishee will provide you with the necessary steps to take.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.